Trinidad and Tobago back on energy map

August 6

Energy Minister Stuart Young toured the NESC drilling rig at the Ste Madeleine campus on August 6.

Visiting the National Energy Skills Centre in Ste Madeleine, Energy Minister Stuart Young highlighted a world of opportunity that students could access in the global energy industry, following efforts to attract the attention of major international energy players to TT.

In reports on their performances for the second quarter of 2024, Shell and BP made positive references to projects in TT. Shell mentioned its final investment decision (FID) on the Manatee field.

On July 9, Shell said Manatee will competitively grow its integrated gas business by building on development efforts in the East Coast Marine Area. ECMA is one of the most prolific gas-producing locations, site of Shell’s largest gasfields including Dolphin, Starfish, Bounty and Endeavour. Manatee gas field will provide backfill for the Atlantic LNG plant, increasing utilisation at existing LNG plants, an important lever to maximise potential from Shell’s existing assets. Starting production in 2027, Manatee is expected to reach peak production of 104,000 barrels of oil equivalent per day (boe/d) (604 MMscf/d).

BP CEO Murray Auchincloss said, “In Trinidad we have a long history and very strong relationships and we are executing a range of actions to reshape the business for the future. We’re accelerating growth enabled by the recent Atlantic LNG restructuring. We are making strong progress at Cypre and Mento major projects.”

BP expects to start up these projects in 2025 with a combined net peak production capacity of 75 mbod (million barrels of oil per day).

“We have taken FID on Coconut and doing the FID on Ginger, the next investment expected to feed the domestic and LNG market. And we have secured an exploration and production licence for Cocuina enabling a material potential development of the Manakin-Cocuina cross-border gas resource.

“Together, this creates a higher-value Trinidad gas business with clear line of sight to material high-margin growth over the next several years.”

Young and the Prime Minister have annual conversations with Auchincloss and Shell CEO Wael Sawan about investments of their companies in TT. This level of engagement with BP, Shell and other energy companies was possible because of several meetings they held since September 2015.

“To meet with these people is not an easy thing. These are global players. We have re-established the importance of that relationship. The reason we do that is for you, the young people, to create the opportunities for you.”

A common topic of conversation with both BP and Shell is the need for more local content.

“This is not politicians in Trinidad saying this is what is going on in the industry. These are two of the CEOs of global energy companies quoting extensively, as they talk to the world, about what they are doing with TT. There are significant opportunities.”

Young urged students to ignore naysayers who predict doom. He quoted nationals who found employment in energy projects in different parts of the world, having started at NESC. The academy features prominently in government plans to develop the economy.

bpTT’s Joe Douglas rig in Cypre field“.. there is.. literally a world of opportunities now. I am pushing to get more drilling done in TT.”

This included more drilling by local companies. He was heartened to learn that former NESC graduates return home to play their part in strengthening the domestic energy sector.

NESC president Kern Dass said the centre was established in 1997, the drilling academy began in 2013 and 4,000 students have graduated to date. NESC is continuously seeking opportunities to expand.

NESC is growing regionally. He identified Guyana and Suriname as two countries where NESC wants to expand operations. NESC is speaking to a training provider in Nigeria, exploring opportunities there. Some international students at the academy were from Nigeria.

UNC criticized Paria US$7b bill for refined products

13 August

Citing reports of a freedom of information request by Anthony Dopson, UNC Senator Wade Mark attacked the government for spending over US$7 billion to import refined fuel products over the last six years.

Paria said it spent US$430,773,410.61 of refined products between April 1, 2024, and June 30, 2024, and regionally it sold US$263,882,807.18 of refined products.

TT Central Bank noted energy companies are the third largest user of foreign exchange reserves, with the largest being retail and distribution, followed by the automotive industry. UNC analysed expenditure by Paria Fuel Trading Company to import refined products from December 1, 2018 to June 30, 2024.

- “From December 1, 2018 to September 30, 2019, US$997,760,993 was spent.

- From October 1, 2019 to September 30, 2020, US$884,489,256 was spent.

- From October 1, 2020 to September 30, 2021, US$1,046,361,904 was spent.

- From October 1, 2021 to September 30, 2022, US$1,996,381,525 was spent.

- From October 1, 2022 to September 30, 2023, US$1,389,187,961 was spent.

- From October 1, 2023 to June 30, 2024, US$1,291,613,621 was spent.

This adds up to a total of US$7,605,795,200.”

Mark said when the Petrotrin refinery was in operation, Trinidad and Tobago was earning money, as the refinery was selling to regional partners.

Paria spent US$430m in 3 months

In response to a Freedom of Information Act request by Anthony Dopson on July 8, Paria Fuel Trading Company Ltd said it spent over US$430 million in a three-month period to import refined products.

Dopson submitted the FOIA request asking Paria to answer:

- • How much royalties Paria paid to the Government since financial year 2019 to June 2024;

- • Value in USD of refined products imported by Paria for the period April 1, 2024, to June 30, 2024;

- • Value from sale of refined products sold locally in TTD that were imported by Paria for the period April 1, 2024, to June 30, 2024;

- • Value from sale of refined products sold regionally in USD that were imported by Paria for the period April 1, 2024, to June 30, 2024.

In response, Paria stated it does not pay royalties to the Government.

- The US-dollar value of refined products imported by Paria for the period April 1, 2024, to June 30, 2024 was US$430,773,410.61.

- Value from the sale of refined products sold locally in TTD that were imported by Paria for the period April 1, 2024, to June 30, 2024, was TT$1,544,451,736.49.

- Value from sale of refined products sold regionally in US dollars that were imported by Paria for the period April 1, 2024, to June 30, 2024, was US$263,882,807.18.

Foreign reserves situation

Commenting on the information, former energy minister Kevin Ramnarine said Paria is a net user of US dollars and will always be trying to source US currency. Paria needs US dollars to import fuel which it then sells to National Petroleum (NP) and Unipet in TT dollars. Paria also sells to the regional market and is paid in US dollars. Ramnarine said Paria sources US dollars it needs from its own reserves or from commercial banks it does business with.

“I suppose the salient issue is the closure of the (former Petrotrin) refinery versus the business model of Paria. The present Government will argue that Petrotrin imported most of its crude oil diet for the refinery. While that is correct, it cannot be the reason for the closure of the refinery as we were always importing most of the refinery’s crude oil requirements.

“Petrotrin spent US$1.6 billion and US$1.7 billion to import crude oil in 2016 and 2017, respectively. However, crude was refined into petroleum products, the majority of which was exported, earning US dollars for Petrotrin.

“A minority was sold into the local market for TT dollars. Petrotrin was never a net user of US dollars. That is one of the myths which was floated around the time of the closure. Petrotrin stood on its own two feet, as far as US dollar supply was concerned, and paid for its purchases of crude oil from its own US dollar cash flows.”

The whole issue of Trinidad and Tobago’s foreign reserve depletion is being confused.

“That confusion does a great disservice to the country, as it allows the real reasons to slink to the sidelines. Our sharp foreign reserve decline is mainly related to lower energy revenues which are, in turn, are related to lower oil and natural gas production.”

Economist Indera Sagewan observed that the amount of forex being expended is a natural consequence of the decision to close Petrotrin, which meant T&T was no longer refining oil but moved to importing oil the country needs. The only way that can be bought is with foreign exchange. The information provided was only for a three-month period and in order to do a proper analysis of what transpired since the closure of Petrotrin, data from the entire timeline was required to see the trend.

Paria is purchasing gas on the open market and is open to fluctuations in the global market. In 2022 when the war in Ukraine started and there was a significant escalation in the price of oil, this would have translated to a much higher usage of foreign exchange by Paria.

Sagewan said while US$430 million was spent on importing products, Paria sold US$263 million in products to the region.

Petrotrin always imported oil in order to refine because the volumes this country was producing were too insignificant and the grade of oil was not a quality that could have been refined wholesale.

“The bottom line is that we can say categorically that the decision to privatise Petrotrin and simply import fuel has resulted in an increased usage of the country’s scarce foreign exchange. There has been no net earning…Paria is not earning more foreign exchange than it is using, which is a strain obviously on the scarce foreign exchange situation,” she said.

Jindal, the Indian Iron Raja flees poisoned Petrotrin

… dumps refinery bid

August 5, 2024

On June 17: Prime Minister Rowley greeted Naveen Jindal, chairman of Jindal Steel and Power Ltd, at the Diplomatic Centre, following their meeting……..

Jindal Steel and Power Ltd, led by its chairman, businessman Naveen Jindal, is no longer interested in investing in Trinidad and Tobago. Prime Minister Dr Keith Rowley told the Diego Martin West constituency conference he received a letter from Jindal on July 26, informing him of the decision to no longer pursue putting in a bid for the mothballed refinery.

Personal attacks against Jindal, who visited Trinidad in June, was the major reason for his company changing its mind.

“When Mr Jindal came he thought it was interesting and he had until July 31 to put in the proposal. He came, visited and left. The Opposition Leader launched an attack on Naveen Jindal. All that happened is that politicians launched an attack on Naveen Jindal personally. This is a man who is chairing a conglomerate that produces 40% of India’s steel and has investments around the world.”

“I received a letter from Mr Jindal on July 26, after having come to Trinidad and Tobago, expressing an interest in our mothballed refinery. He said it would involve an investment of approximately $US700 million. One of the reasons why the refinery was a money loser was because it was obsolete and to bring it back into operation, it means that you have to upgrade it significantly.

One of the upgrades includes putting in modern technology because some of those dials are 100 years old. You would have to spend some significant money on the physical management of the refinery and this is from a company that has the ability to do it.

Not like some people who want the refinery and cannot pay their lawyer. I am talking about a multi-billion-dollar company and the only thing that could happen from the other side of the Parliament was to launch an attack on the man.”

“This is an investor who was prepared to consider putting in a bid in the offer of approximately US$700 million to bring that refinery into operation, and the only people in this country who don’t want that to happen is a handful of politicians who don’t care because they prefer to have the refinery there than to see it re-started and operated in a different way for the benefit of the people of Trinidad and Tobago. This is Sandals all over again. The same way people are now ruing the loss of opportunity, I will say that is a result of the behaviour of parliamentarians who should be encouraging investment.”

In the letter sent by Jindal to Rowley he said, “The Jindal Group is one of India’s foremost industrial conglomerates, with investments exceeding $25 billion USD and global operations in steel, mining, power and infrastructure sectors spread over India, Australia, the Middle East and Africa. Our commitment to sustainable and ethical business practices is reflected in our projects, which aim to improve the quality of life in the communities we serve. This dedication to excellence has enabled us to build a substantial presence on the world stage.

“It is with great disappointment therefore, that I must address the reaction led by the official Opposition parties following our visit. The character assassination I experienced merely for considering the investment opportunity in the Guaracara refinery was deeply disheartening and discouraging. Moreover, the unjust attacks directed at our Group’s companies, entities that operate independently and are unconnected to legal matters mischaracterised in the local press and parliament, set a troubling precedent for potential investors planning to invest in Trinidad and Tobago. Having served three times as a member of parliament in my own country, I understand the vital role that the constructive opposition plays in a healthy democracy. However, in my respectful view, the behaviour exhibited by the Opposition in this instance risks causing significant economic and reputational damage to Trinidad and Tobago. Such actions will likely deter potential investors leading to missed opportunities for economic growth and job creation and ultimately disadvantaging the people who would benefit from these investments.

“From our organisation’s point of view, these actions by the purported government in waiting raise serious concerns as they represent an element of risk and potential instability that is incompatible with providing a predictable and secure investment climate. Consequently, these developments have shaken confidence and our companies have felt compelled to reassess the viability of proceeding with a formal bid for the refinery at this time.”

Legal allegations. Rowley met Jindal on June 17. The Office of the Prime Minister had said Jindal Steel and Power is one of India’s leading business houses, with a substantial presence in steel, mining, power and infrastructure. Chairman Jindal’s visit…is a result of Prime Minister Rowley’s recent trip to India where he met business leaders and invited them to explore investment opportunities in Trinidad and Tobago.

Following the PM’s meeting with Jindal, a link to a Forbes news story dated June 12, 2013, was widely circulated. The report said India’s Central Bureau of Investigation (CBI) filed a case against Jindal and former coal minister Dasari Narayan Rao for allegedly misallocating mining rights. Jindal was at that time the head of Jindal Steel and Power and a member of parliament with the ruling Congress Party.

The Forbes report said the federal investigator booked Jindal for what it claims were kickbacks paid by him to the ex-minister, in exchange for being granted mining rights for coal. It has alleged that a year after Jindal’s firm secured a coal bloc in the eastern state of Jharkhand, it invested US$430,000—the alleged payoff—in a company owned by Rao, who was coal minister between 2004 and 2008 when the mines were allocated.

Asked if he was aware and whether this issue has the potential to affect any business deals, Rowley responded: “I am totally unaware. We have an open invitation out to attract foreign investment. We are getting good response but we have not conducted any forensic investigations, but we are confident that we will be able to deal with all circumstances according to our own standards of behaviour in keeping with the laws of Trinidad and Tobago.”

In mid-July the Prime Minister again defended his administration’s decision to restructure former State-owned oil company Petrotrin and rebuked critics over “scandal” allegations surrounding his meeting with Jindal.

He told San Fernando West annual constituency conference, that, following Petrotrin’s restructuring, the Government had sought potential owners for the refinery as the country lacked the capacity to make it a profitable business. He criticised the furore that followed Jindal’s visit in June, stating he had been seeking the best interest of the country .

“ That tells me that these people have absolutely no interest in a good outcome for the people of Trinidad and Tobago.They called for me to be investigated and arrested because I talked to Jindal; well in that case, I should have been locked up a long time ago. I spent so many hours talking to the people of BP, BHP, Shell, all of them big investors in Trinidad and Tobago. Since it is improper and illegal for the Prime Minister to talk to these people, why haven’t you locked me up since then?”

In June,UNC Leader Kamla Persad-Bissessar urged Rowley to address allegations of corruption involving Jindal and questioned his reported connection to Venezuela. She described a potential partnership deal as a scandal.

Saga of a Refinery albatross

August 8

Prime Minister Rowley met with Indian businessman Naveen Jindal. Photo courtesy OPM

Six years ago, on 30 August 2018, the eve of the 56th independence anniversary, the consequential closure of the paramount Pointe-a-Pierre refinery, once the largest in the British Empire and Comm0nwealth, marked an ignominious end to a major profitable venture.

Following independence in 1962, the power-hungry Prime Minister, Eric Williams BA, DPhil (Oxon), armed with degrees funded by British imperial taxes at world-class University of Oxford, launched nationalisation of the iconic oil industry in 1969, unleashing blackpower, forerunner of dire decolonisation, now in frenzied flow under a complacent regime.

Purchase of the refinery from American giant Texaco in 1985, after the death of the wily Williams, led to the demise of one of the most strategic industries in energy history.

The anti-American history don, fugitive from US courts, lover- boy losing 3 wives in serial domestic dysfunction, whose characteristic weakness, secrecy and affinity for gossip were sources of serious political indiscipline and intolerance, instigated cancel culture, renaming Woodford Square.

His Balisier Bandwagon barrelled from scandal to scandal, bankrolled by booming global oil prices. Destruction continues of the prosperity that began In 1857 when Merrimac Company of USA produced oil in La Brea and In 1865-66 when American engineer Walter Darwent produced oil in Aripero, growing in the 1890s when natural gas was detected, rising in 1902 when Randolph Rust and Lee Lum found the first commercial oil in Guayaguayare, the land Columbus first sighted in 1498 in Trinidad, culminating in 1916-17 when Trinidad Leaseholds Limited built a refinery in Pointe-a Pierre.

From 1930 oil was pumped from Guayaguayare oilfields to the Pointe-a-Pierre refinery where TLL burnt associated natural gas, creating the eternal flame, bedrock of the economy, omitted from the Coat of Arms, now being mutilated to include a steel pan.

The refinery will be an albatross around the neck of the moribund petrostate, until it is sold or leased, as per the original rationale behind its 2018 closure. Woeful wars of words with the Opposition, over loss of investment of US$700 million into the mothballed facility, is the latest symptom of deeper anxieties about the economy amid a dynamic global environment, a sign the options are shrinking after it backed itself into a corner with excessive delay.

In an initial process to dispose of the refinery in 2019, there were 77 expressions of interest. Since then, enthusiasm has waned. Energy Minister Stuart Young on August 6 said “just above ten” bids were being considered. In April, a parliamentary committee heard there were eight. In March, “two offers emerged, one promising, one very interested.”

Opponents aired valid questions about procurement processes but these paltry figures add a different tone to the courting of buyers amid a sense wanting to get rid of this asset. Since closure, it has cost the State t $36 million to preserve the refinery. The longer the closure, the greater the degree of breakdown; the more expensive it will be to upgrade and reopen.

“There is no greater driving force in trying to get somebody to take it off our hands,” said Michael Quamina, SC, who heads the refinery company’s parent entity.

Ironically, the Opposition may have helped the undiplomatic leader dodge a bullet, if it is true he was unaware of the issues . Given the standard rigours of due diligence, it is better for these to have arisen sooner rather than later.

The UNC appears sympathetic to trade union desires to take hold of the refinery, a move that would please workers, end the labour problems that dogged its operations for decades and absolve the State of fiscal and political responsibility. This would also open new risks relating to management style and regional status.

A new owner could run the refinery in co-operation with petrostate Guyana. However, all parties are silent over implications of the global transition from fossil fuels, closure of regional refineries and the Venezuelan threat to Guyana. Habitually poor communicators, parties were slow to outline what the facility means ideologically- a source of revenue, employment, security or geo-political bargaining chip. Until answers are found, it will remain a burden with a precarious future, no matter who owns it.

Jindal not only potential investor in refinery

8 August 2024

Economist Indera Sagewan says the decision by Jindal Steel and Power Ltd to withdraw the refinery bid will not tarnish this country’s international image. Jindal was not the only potential investor for the refinery as there are still others to be considered, and the deal is not off the table. This is not the first or second attempt by the Government to revive the refinery. The longer it takes the more difficult it becomes to restore the infrastructure. The threat is not so much Jindal bolting but whether the cost would be worth the while of any potential investor so to do.

Since Jindal’s visit on June 17, the UNC and the Oilfields Workers’ Trade Union (OWTU) have targeted the ironman.

The UNC warned he should be disqualified from bidding for the refinery and urged the PM to address allegations of corruption , questioned Jindal’s reported connection to Venezuela.

However, Sagewan said as Jindal fell under the category of foreign investor there was nothing wrong with a call for due diligence regarding Jindal or any other potential investor.

Noting deterrents already alarming potential investors, Sagewan said, “Crime being the biggest issue. People are very concerned about bringing their money where it could be under threat because of the high level of criminal activity. The foreign exchange situation in this country is another major one because a foreign investor wants to know there is easy ability to repatriate profits to their home country. Then there is the ease of doing business and the length of time it takes to register a business and the issues relating to contracts. There is so much from a policy level we are doing wrong.”

Blame crime, bureaucracy for foreign investors fleeing

2024, 08/06

Economists and political scientists dismiss the Prime Minister’s suggestion that the Opposition is chasing foreign investors. Instead, they say Government should blame crime and bureaucracy for damaging the ease of doing business.

Political scientist Dr Bishnu Ragoonath said Jindal may have had more serious reasons for pulling out, adding the Opposition was simply holding Government accountable.

“Mr Jindal took an easy approach out by simply blaming the Opposition in saying that he’s not going to invest. If, however, his company was ready and willing to invest in Trinidad and Tobago, they would have been able to deal with that. His concern was character assassination but how you could talk about Trinidad when the matter itself arose in his own country and he is before the courts?”

Economist Dr Marlene Attzs agreed there may have been other factors that led to Jindal’s decision, but did not wish to speculate. She debunked Rowley’s claim the UNC is turning investors away. Foreign direct investment (FDI) in T&T has been less than one per cent of GDP or negative for years. This cannot be blamed on the Opposition, as T&T has made itself unattractive to investors for varying reasons. A challenge for potential investors may well be the continued levels of crime and the bureaucracies involved in doing business locally—as the now discontinued Ease of Doing Business indicators have often suggested.

Economist Dr Vanus James suggested that deals are failing because of Government’s high-handed approach to avoid consulting the wider population. It was unlikely Jindal was affected by T&T’s politics.

“I am not aware that the political climate has done a lot to dissuade investors in those sectors. I would listen to the Prime Minister’s comments and treat it as ordinary run-of-the-mill politics in which the government in power tends to treat the opposition as though they don’t really belong in the country and shouldn’t say anything about anything and that’s historically true for all governments I have seen.”

While Rowley likened Jindal’s decision to the failed Sandals project, it was Government’s failure to seriously consult the population that led to public ire.

“It’s the system of authoritarian government that led to the public reaction that bred the reaction of Sandals and if we ran a different system of government then we would reap different rewards. I don’t know if Dr Rowley expects citizens, including the Opposition, to say nothing when the Cabinet makes decisions. We are not his slaves.”

The United National Congress said it had no regrets over its role in Jindal opting out of bidding for the refinery.

Analysts tell PM: Don’t blame Opposition for foreign investors leaving

by Dareece Polo

2024, 08/06

Political analyst Dr Bishnu Ragoonath

Economist Dr Marlene Attzs

Tobago economist Dr Vanus James

THA INFO DEPT

Economists and political scientists are rubbishing Prime Minister Dr Keith Rowley’s suggestion that the Opposition is driving away foreign investors. Instead, they say the Government should blame crime and bureaucracy for damaging the ease of doing business.

On Friday evening, Rowley read excerpts of a letter sent to him by Indian businessman Naveen Jindal, the chair of Jindal Steel and Power Ltd, at the swearing-in of the new executive of the PNM’s Diego Martin West constituency.

In the letter, Jindal said his company would no longer bid for the Petrotrin refinery because comments made by the “government in waiting” represented a level of risk and potential instability that did not align with providing a predictable and secure investment environment.

“The character assassination I experienced merely for considering the investment opportunity in the Guaracara Refinery was deeply disheartening and discouraging,” the letter stated.

However, political scientist Dr Bishnu Ragoonath yesterday said Jindal may have had more serious reasons for pulling out, adding the Opposition was simply holding Government accountable.

“Mr Jindal took an easy approach out by simply blaming the Opposition in saying that he’s not going to invest. If, however, his company was ready and willing to invest in Trinidad and Tobago, they would have been able to deal with that.

“His concern was that there was some degree of character assassination but how you could talk about Trinidad doing character assassination when the matter itself arose in his own country and he is before the courts?” Ragoonath asked.

Economist Dr Marlene Attzs agreed there may have been other factors that led to Jindal’s decision, but did not wish to speculate. However, she debunked Rowley’s claim the UNC is turning investors away. She said foreign direct investment (FDI) in T&T has been less than one per cent of GDP or negative for years. Attzs said this cannot be blamed on the Opposition, as T&T has made itself unattractive to investors for varying reasons.

“A challenge for potential investors may well be the continued levels of crime and the bureaucracies involved in doing business locally—as the now discontinued Ease of Doing Business indicators have often suggested,” she said.

Meanwhile, economist Dr Vanus James suggested that deals are failing because of Government’s high-handed approach to avoid consulting the wider population. James said it was unlikely for Jindal to be affected by T&T’s politics.

“I am not aware that the political climate in the country has done a lot to dissuade investors in those sectors. I would listen to the Prime Minister’s comments and treat it as ordinary run-of-the-mill politics in which the government in power tends to treat the opposition as though they don’t really belong in the country and shouldn’t say anything about anything and that’s historically true for all governments I have seen,” he said.

James said while Rowley likened Jindal’s decision to the failed Sandals project, it was Government’s failure to seriously consult the population that led to public ire.

“I would say it’s the system of authoritarian government that led to the public reaction that bred the reaction of Sandals and if we ran a different system of government then we would reap different rewards. I don’t know if Dr Rowley expects citizens, including the Opposition, to say nothing when the Prime Minister and the Cabinet makes decisions. We are not his slaves,” he said.

Over the weekend, the United National Congress said it had no regrets over its role in Jindal opting out of bidding for the mothballed Guaracara refinery

Visiting minister deepens Indian ties

August 24

Indian Minister of State for External Affairs Pabitra Margherita, second right, greets Prime Minister Dr Keith Rowley at the Diplomatic Centre in St Ann’s during his official visit to TT on August 23. Looking on are Foreign Affairs Minister Dr Amery Browne, right, and Indian High Commissioner Dr Pradeep Rajpurohit. – Photo courtesy the Indian High Commission

In the first ministerial-level visit to Trinidad and Tobago since April 2017, Minister of State for External Affairs Pabitra Margherita of India visited Trinidad on August 23 to deepen ties between the countries. Margherita paid a courtesy call on the Prime Minister at the Diplomatic Centre in St Ann’s.

He received a warm welcome with a flag-raising ceremony at the Ministry of Foreign and Caricom Affairs where he held talks with Minister of Foreign Affairs Dr Amery Browne, “on areas of mutual interest, including collaboration in digital transformation, health, agriculture, sports, cultural exchanges, etc.”

They discussed regional and global issues and signed an agreement for the authorisation of employment of dependents of members of a diplomatic mission or consular post in India and Trinidad and Tobago.

On August 24, Margherita visited the Parliament in Port of Spain and paid a courtesy call on the President of the Senate and Speaker of the House. The Speaker’s Chair was gifted by India in 1968.

Gifts were exchanged including a painting of the Red House.

Margherita and Port of Spain Mayor Chinua Alleyne laid flowers at the statue of Mahatma Gandhi in the city.

At the Mahatma Gandhi Institute for Cultural Co-operation (MGICC), Mt Hope, Margherita met the local Indian diaspora and inaugurated an exhibition on “Ramleela Traditions in the Caribbean Region.”

The visit added a new impetus to the deep-rooted relations between India and Trinidad and Tobago, reaffirming continued commitment of both countries to strengthening bilateral partnership and further deepen their people-to-people ties.

Businessman Sieunarine Coosal who attended the event at MGICC brought greetings on behalf of the Indian diaspora in Trinidad and Tobago.

Minister Pabitra Margherita, left, with executive chairman of the Coosal Group of Companies Sieunarine Coosal

Minister Pabitra Margherita, left, with executive chairman of the Coosal Group of Companies Sieunarine Coosal

“The Indo-Caribbean diaspora is relatively large, highly educated and successful. But outside of cultural co-operation there is enormous scope for closer strategic and economic ties between India and the Indo-Caribbean diaspora.”

The executive chairman of the Coosal Group of Companies urged Indian Prime Minister Narendra Modi to “initiate a programme of state visits to usher in a new era of bilateral relations.”

He sought more cooperation in agriculture, farming and food processing and the creation of an Indian Caribbean business council to promote bilateral trade.

Indian robots for healthcare

Having generously provided Covid-19 vaccine to the region, India has again demonstrated its humanity overseas with a splendid gift to Trinidad and Tobago of eight new healthcare service robots (HSRs) to reduce the administrative burden on healthcare workers in the public health system.

On August 17, the Ministry of Health said the robots will allow the workers “to focus on more critical patient care tasks, which are crucial for maintaining patient care continuity.”

The HSRs will be strategically distributed. The robots were funded by the India – UN Development Partnership Fund. The Indian High Commission said this marks the successful completion of US$1 million project funded by the government of India.

“Bringing low and high technology to deal with covid19.”

High Commissioner Dr Pradeep Rajpurohit said, “The project is an excellent example of South-South Co-operation and growing development partnership between India and Trinidad and Tobago.”

Also present were Terrence Deyalsingh, Minister of Health and Dr Gabriel Vivas Francesconi, PAHO/WHO representative for Trinidad and Tobago and the Dutch Caribbean islands and other senior officials.

A Statement by the T&T Chamber of Industry and Commerce

Advancing Trinidad and Tobago’s Economic Prosperity

…a vision for the future

31 July

AS we look to the future, the T&T Chamber remains steadfast in its belief that progress leads to prosperity for all. Our 145-year history as the Voice of Business in Trinidad and Tobago attests to our commitment to driving policies and initiatives that enhance our nation’s economic landscape.

A Road Map for Growth

Our strategy is clear: we must increase economic participation and create new opportunities for shared prosperity. This means focusing on key areas such as social infrastructure improvements via ESG mandates, embracing emerging technologies, promoting digital adoption, and fostering innovation. We also aim to uncover hidden opportunities that can drive economic advancement and inclusion, especially for our MSMEs and untapped sectors.

Global Aspirations

Our ambition is to align Trinidad and Tobago with the most progressive emerging countries. Unlike many of these nations, we have had the advantage of a robust energy sector. Yet, sustainable economic progress requires a broader approach. This year, our Business Outlook meeting provided valuable insights from both the private sector and state actors on how best to support entrepreneurial success.

Innovation, risk-taking, strategic planning, and productivity improvement are crucial for thriving business models. While we remain optimistic about our economic trajectory—thanks in part to significant contributions from non-energy sectors and ongoing digital transformation—we understand that SMEs need more support. This includes better access to finance, improved public service infrastructure, and enhanced capacity to leverage growth opportunities.

Strategic Partnerships

Our collaboration with the Trinidad and Tobago Stock Exchange’s Small and Medium Listings initiative exemplifies our commitment to supporting SMEs. We are also facilitating discussions around venture capital, guiding angel investors, and exploring public-private partnerships and joint ventures with foreign direct investment. Our focus extends to nurturing youth potential and upholding the ideals of diversity, equity, and inclusion, aligned with the sustainable development goals of the 2030 UN Agenda.

Expanding Market Opportunities

From April to June 2024, the T&T Chamber led trade delegations to key international destinations to explore new market opportunities. Our Trade Mission to Las Vegas, which included participation in the NAB—the world’s largest broadcast and entertainment expo—aimed to boost our Orange Economy. Creative TT’s incentive scheme supports our diverse content creators, positioning us for significant growth in this sector.

Trade missions to Guyana and Jamaica highlighted our dedication to strengthening ties within the Caricom region and opening new commercial avenues for export-ready firms. Following our successful mission to Barbados in October 2023, we have seen many companies secure export orders, while others are actively pursuing promising leads. We continue to monitor and support their progress.

Supporting SMEs

Our Trade and Business Development Unit is focused on understanding and addressing the needs of SMEs nationwide. This groundwork is essential for forming partnerships that provide targeted support. Events like the recent Digimark Conference, organized by our NOVA committee, and the upcoming SME Conference next year underscore our commitment to this sector.

Looking Ahead

As part of the global community, Trinidad and Tobago faces familiar challenges but has shown remarkable resilience. Through collaboration with local and international stakeholders, we strive to maintain our nation’s attractiveness as a destination for investors and strategic partners.

Our twin-island Republic has immense potential beyond the oil and gas sector. Now is the time to embrace risks and seize new opportunities. As the collective Voice of Business, representing the strength of hundreds, we are dedicated to advocating for the prosperity of our members and our country.

Originally delivered as the Opening Address at the 2024 Business Outlook meeting “Pathways for Entrepreneurial Success on the Global Stage,” by Ms Kiran Maharaj, president of the T&T Chamber of Industry and Commerce held on July 18, 2024, at the Trinidad Hilton & Conference Centre.

Partnering with US in renewables

31 July

ENERGY Minister Stuart Young underscored the importance of Trinidad and Tobago partnering with the US in renewable-energy initiatives at the opening of a workshop training session hosted by the US Department of State Bureau of Energy Resources (ENR) Power Sector Program (PSP)on July 29.

Young said TT must continue to partner with the US and learn from its experiences with respect to the need to transition from non-renewable to renewable energy sources over time. He urged the local and foreign participants to consider the “bankability” of renewable energy projects in the region, as factors such as the small population sizes of small island developing states (SIDS) affect their financial ability to refurbish grids for taking on the increased volume of electricity coming in from renewable energy.

US Ambassador Candace Bond agreed. She highlighted the US Embassy’s commitment to supporting clean-energy development in TT.

Atlantic youth vacation programme

28 August

Atlantic continued its commitment to youth development with its recently concluded Vacation Internship Programme. This year’s cohort featured 21 interns, including employees’ children, students from the University of Trinidad and Tobago. (UTT) and from Atlantic’s longest-running sustainability programme, Point Fortin’s Finest Leadership Development Programme.

Spanning eight weeks from July-August, the programme provided hands-on training and valuable exposure to real-world work environments. The interns engaged in stimulating projects that allowed them to apply their academic knowledge to practical scenarios, supporting their holistic development into future leaders, a media release said.

Throughout the programme, the interns participated in various training sessions, including work etiquette and workplace stress management. Each intern was paired with an Atlantic buddy/mentor to ensure personalised guidance and support. In addition, the interns designed and executed a philanthropic group project aligned with Atlantic’s sustainability pillars, reinforcing the company’s commitment to community development and engagement, the release said.

Atlantic’s vice president, people and culture, Arlene Hendrickson said , “This year’s Vacation Internship Programme was particularly significant for us, as it marked the first time in 12 years that the children of our Atlantic team were included.

“Not only did we see an incredible blend of talent and passion, but this programme also underscored our commitment to building a generation of future leaders. We are immensely proud of the contributions our interns have made and look forward to their continued growth and success.”

Programmes like these are vital, especially in the energy sector, where innovation and leadership are key to driving progress. By investing in the development of young talent Atlantic is not only fostering the next generation of industry leaders but also ensuring the sustainability and resilience of the energy sector for years to come.

INDEPENDENCE DAY MESSAGE

Kamla: Eliminate threats to T&T’s independence

2024, 08/31

Opposition Leader Kamla Persad-Bissessar has suggested that this country’s sovereignty is being eroded through globalisation.

In her message to mark this country’s 62nd Independence Day celebrations, Persad-Bissessar said international colonial masters have been replaced by international corporate masters.

Persad-Bissessar said: “A proper analysis will show that our behaviours on governmental and personal levels have moved from being previously controlled by other nations to now being controlled by global corporations and international oversight bodies, particularly through the financial, food, medical, energy and IT sectors.”

She pointed to the role of the World Health Organisation (WHO) during the COVID-19 pandemic.

“We saw the WHO coerced independent nations to lock down citizens and mandate the acceptance of a vaccine that was later proven to be ineffective,” she said.

Stating that the internet has become the greatest interference tool in the internal affairs of independent nations, Persad-Bissessar noted:

“The large social media companies and search engines influenced by their corporate advertisers and Governments, censor free speech by categorising opinions opposite to their beliefs and interests as hate speech. They dictate what morals and values are appropriate, they erode your religious liberties and online mobs determine which causes and groups are just and which are evil.”

She sought to encourage citizens to urgently eliminate threats to the country’s independence for future generations by fixing our internal issues with local innovation and ingenuity.

“I urge citizens to draw strength from the memory of our foreparents and work to regain our sovereign decision-making and preserve our independence. Let us embody the spirit of personal responsibility, invention, and unity of purpose to set our country on a path of self-sufficiency and self-determination.”

Persad-Bissessar expressed faith that the situation could improve with the support of citizens.

“Undoubtedly, we will face serious challenges, but we must have faith that we will overcome them all once we work together, with a common resolve.”

INDEPENDENCE DAY MESSAGE

PM: Real prospects for a brighter future

2024, 08/31

Prime Minister Dr Keith Rowley has called on citizens to celebrate the things that make T&T great.

In his Independence Day message, Rowley encouraged citizens to consider the achievements of the country over the past 62 years compared to countries affected by geo-political issues.

“Maybe here, in this comparison, notwithstanding the many difficulties that we have to confront daily, we may better appreciate our overall achievements, our resilience as a people, our natural and cultural wonders, and the beauty and richness of this land, called Trinidad and Tobago.”

Noting that this country sets an example of racial harmony and respect for each other, which must not be dismissed or understated, Rowley added:

“This unique facet of T&T has caused some observers to describe our inter-racial relationships as “uncommon”.

“Whatever our race or status, our unique, collective Trinbagonian spirit stands out, wherever, because we always expect to be enjoying and enhancing our daily lives, protecting our freedom, celebrating our music, our dance, our food, our fashion and, of course, our Pan.”

He acknowledged that the country was not immune from violent crime caused by family disputes, meaningless altercations and gang culture.

“Yet, looking deeper, we can identify and praise what we call ‘The Trinbagonian’ – our collective spirit in which we hold a transcendent respect for the Almighty, alongside an eager willingness to display kindness, selfless care, compassion, respect, love, sharing with family and friends, and extending trust to strangers, as fellow humans all wrapped in a daily ambition to be better.”

Rowley devoted a significant portion of his message to highlighting initiatives undertaken by his government since being elected in 2015. He pointed to vocational and skills training being offered by the Ministry of Youth Development and National Service.

“The agriculture projects are exciting initiatives which have already produced their first graduates and first harvests,” he said, noting that 1,500 young people are expected to benefit over the next year.

Rowley also praised the country’s robust social services.

“Thousands of our most vulnerable citizens continue to benefit from social grants, social services, free healthcare and medicine, in addition to Government subsidies for water, electricity, transportation, and education grants,” he said.

He mentioned the restructuring of the State energy company Petrotrin and deals with Venezuela for the development of natural gas fields on the border of both countries.

“These projects will boost this country’s declining gas production, will sustain the plants on the Point Lisas Industrial Estate and are the basis for the Government’s optimism and hope for our secure future,” he said.

Rowley stated that inflation is below one per cent, the unemployment rate was 4.1 per cent last year, and the country’s external reserves and Heritage and Stabilisation Fund (HSF) are approaching US$6 billion.

“So, today as we celebrate our Independence 62, I ask that all citizens join me in committing to this optimistic spirit.

“I assure you that your Government is fully engaged as we address all the major issues while pointing to the real prospects for a brighter future.”

Pirates boarding barge in Sea Lots spark shootout

2024, 08/24

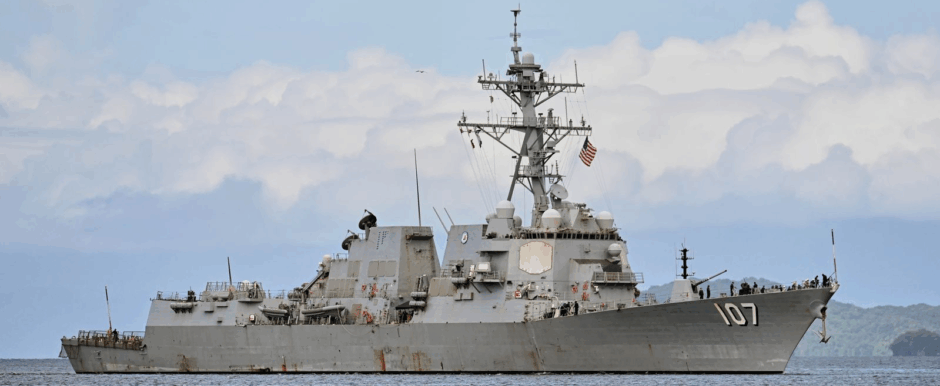

Following arrival of the convoy escorting the Gulfstream barge at Sea Lots, on 22 August 2024,

Trinidad and Tobago Coast Guard (TTCG). thwarted an unauthorized boarding of a support vessel at the Gulfstream wreck site . Unidentified individuals tried to access the vessel, triggering a swift response from security forces stationed at the site.

The Ministry of Energy confirmed the incident, noting that an exchange of gunfire occurred during the confrontation. A Coast Guard officer sustained a non-life-threatening injury and received medical care. The Ministry assured the public that the Gulfstream site remains under strict protection by the TTCG and the Trinidad and Tobago Police Service (TTPS), emphasising that safety of personnel involved in the operation is a top priority.

In coordination with the Ministry of National Security, the TTPS, TTCG, and the Trinidad and Tobago Regiment, the MEE Implemented heightened security measures to safeguard the site and ensure the ongoing safety of those involved in the operation.

Authoritarian politics blitz progress in energy

With an exclusive economic zone 15 times the size of its land mass, the ocean state requires a clear and coherent governance framework for sustainable management of resources in an ocean-based economy, reliant on shipping.

Yet the government wastes time and taxes mutilating its emblem to replace iconic ships with a steel pan, in a cynical spree of populism and inane ideology.

Sustainable Blue Economy

In 2019 at the Caribbean Development Bank, the Prime Minister urged the region to ‘harness the true potential of the blue economy’, highlighting the need to ‘leverage coastal and marine resources to generate sustained growth, unlocking the great potential of shipping industries’.

Key laws and policies relevant to an SBE exist but initiatives are not given priority, leaving critical gaps in the governance framework. With no unified vision for the SBE , forthcoming legislation and strategies may lack coherence to deliver sustainability across these sectors and to manage competing priorities efficiently and effectively.

Shipping and Growth

With two ports, containerised cargo volumes exceeded pre-pandemic levels by 11%. Expansion of national port capacity and productivity factors strongly in the ability to benefit from this global phenomenon.Shipping lines prioritise eco-friendly practices, digitisation and automation to streamline processes and improve efficiency.

Initiatives such as the Port Community System led by the Ministry of Trade and Industry are needed to integrate the supply chain digitally.

Accessing foreign exchange, mainly US dollars, remains a challenge, requiring proactive planning and flexibility. Focusing on infrastructure development, cost-effective connectivity, sustainability and technological advancements, Trinidad and Tobago can position itself as a thriving shipping hub, facilitating regional trade and attracting global investments.

Industry self-regulation is imperative to ensure compliance with business, safety, and environmental standards, and a framework is underway.

GDP per capita of approximately USD$19,692 and annual GDP of USD$27.9 billion in 2022, the highest in the region, was expected to grow by 3.5 percent in 2023. The largest economy in the English-speaking West Indies prospers from natural gas and petrochemical production. In 2022, the petroleum sector accounted for 29.8 percent of GDP and 81 percent of export earnings, up from previous years due to high global commodity prices following invasion of Ukraine.

The USA remains the main trading partner, accounting for 39.4 percent of the country’s imports and 39.3 percent of TT’s exports in 2022. U.S. exports include petroleum oil, aircraft parts, machinery, chemicals, plastics, food and beverages.

Most investment barriers were eliminated but the investment climate is stymied by delays in obtaining foreign exchange, lethargic state bureaucracy, violent crime, low labour productivity and endemic corruption. A sovereign wealth fund and foreign reserves provide 8 months of import cover to create financial resilience.

TT benefits from a democratic political system jeopardised by endemic criminality and discrimination. A steamroller of political ideology sparks fury over constitution reform as ad hoc selection of a favourite designer for the national Coat of Arms without competitive tender exposed the flaws of delinquent officials bulldozing this juggernaut through protests in a milieu hostile to deadlines and time.

Trinidad and Tobago Central Bank stated Government Revenues increased to TTD 5099.90 Million (USD761 million) in March 2024. Nominal GDP was USD27.29 billion.

Budget revenue was TTD 54.012 billion (USD 782 million) October 2023.

IDB funds US$1,500,000 for Port . April 23, 2023

The Government of the Republic of Trinidad and Tobago agrees to the conditions of technical cooperation to the monetary worth of one million, five hundred thousand United States dollars (US$1,500,000) from the Inter-American Development Bank’s contingent recovery financing technical cooperation for the Port Authority of Trinidad and Tobago.

Minister of Planning and Development, the Hon. Pennelope Beckles, signed on behalf of the Government a Letter of Agreement from the Inter-American Development Bank on April 23, 2023, witnessed by Minister of Works and Transport, Rohan Sinanan and Minister of Public Administration, Allyson West. The signing formalized the terms and conditions for a contingent recovery financing technical cooperation in accordance with the provisions set out in the Letter of Agreement. The project scope is estimated to cost US$1,500,000.

The purpose of the initiative is to provide support to the Government in the structuring activities for a Public Private Partnership Project (PPP) for the Cargo Handling Operations of the Port Authority , where the Port of Port of Spain (PPOS) is the first and major multi-purpose port of the country, strategically located at the crossroads of major trade links via the Panama Canal.

The Technical Cooperation will finance the following activities:

- (i) finalizing feasibility studies (technical, financial, legal) to design the best model and define the framework for bidders to present their proposals;

- (ii) final financial, technical, and legal structure, draft PPP contract, and bidding documents;

- (iii) support to the GoRTT in the bidding process until the commercial close (signature of the PPP contract).

The Government’s objective is to upgrade Port of Port of Spain’s (PPOS) infrastructure through private investments to enhance the competitiveness of and catch up with regional competitors.

The project feasibility studies under the proposed Project Preparation and Structuring Activities (PPSA) will support the government in the structuring process for a potential Public Private Partnership (PPP) for the Cargo Handling Operations of the PPOS.

The ultimate goal of the Project is to promote economic growth and development by improving port efficiency and competitiveness through a PPP in line with the National Development Strategy (Vision 2030) 2016-2030, “Improving Productivity through Quality Infrastructure and Transportation.

Port Authority 2021,

08/29

Port Authority of T&T’s unaudited financials and operating results 2016 to 2020

Each year over the last five financial years the Port Authority of T&T (PATT) recorded multi-million dollar net deficits and the overall loss was over $337.5 million with financial difficulties in three strategic business units, the Port of Port-of-Spain, the Port-of-Spain Infrastructure Company, the T&T Inter-Island Transportation Company and operations at the Port of Scarborough, under its purview.

PATT and its three (3) SBUs, inclusive of the POSCA (Port of Scarborough), have been in a deficit position for many years with government subventions completely funding the Inter-Island Ferry Service and capital expenditure requested annually through the Public Sector Investment Programme (PSIP) for equipment and infrastructure upgrades.

The latter is usually severely under-funded. Expenditure consistently exceeded revenues because of outdated working practices resulting in high labour costs, aged equipment resulting in sub-standard productivity levels and ultimately, higher operational costs. PATT is unable to invest in major capital expenditure. Revenue generation is further stymied by the inability to set competitive tariffs due to operational inefficiencies and lack of infrastructure to attract vessels transiting the region.

PATT is now offering a Request for Expression of Interest for a potential public-private partnership project.

“The Government, operating through the PATT, invites interest from willing investors with experience in port investments, development and operations, shipping, logistics and cruise operations to propose business ideas that will support participation in a PPP Landlord model project with the PATT, in any or all of the following areas:

-

-

-

-

-

-

-

-

-

-

-

- a) The cargo operations at PPOS;

- b) The cargo and cruise operations at the POSCA;

- c) Regional cargo activities at Caricom wharves;

- d) Cruise shipping operations at PATT

-

-

-

-

-

-

-

-

-

-

Potential investors may also consider opportunities in marine services (towage, dredging etc).

The PATT recognises that an effective public-private agreement has the potential to not only generate revenue but also positively enhance the experience of Port users, businesses and the national community. This Expression of Interest (EOI) is encouraging and creating the competitive environment for new agreement(s) to be created. This EOI is designed to give all who may be interested an opportunity to possibly engage in a potential public-private partnership arrangement in the future.

PATT was incorporated by the Port Authority T&T Act 39 of 1961, currently the Port Authority Act, Chapter 51:01 and operates as a statutory authority under the Ministry of Works and Transport. Governed by a Board of Commissioners, PATT maintains an employee complement of 1,516 . It owns 151.8 hectares of land extending from Beetham Highway in the east to Invaders Bay in the west. The port utilises 48.41 hectares for operations. It leases 78.04 hectares, with the remaining 25 hectares in Sea Lots. The Port of Scarborough operates on 3.47 hectares.

It has been transitioning into strategic business units since 2005, when PATT took a decision to de-couple and break into specialised organisations based on functionality to allow each business unit to become autonomous and specialise in its core area of operation. The Port of Scarborough (POSCA) falls within the joint purview of the Port Authority Governing Unit (PATTGU) and the Tobago House of Assembly (THA). Operations include cargo handling and cruise shipping, with potential for expansion in regional transshipment and the cruise business.

PATT facilitates the bulk of trade and provides a gateway to regional and foreign markets, being the largest cargo handling and cruise shipping port in the country. Its market share is 60 per cent of containerised trade in T&T. However, with expansion of the Panama Canal, PPOS lost transshipment cargo to regional ports which invested heavily in infrastructural and equipment upgrades, to capitalise on trade being transported by the larger vessels transiting the canal.”

Expansion of the Panama Canal in 2014 resulted in a structural change in the size of vessels, with shipping lines amalgamating cargoes and containers onto larger 20-foot equivalent units (TEUs) vessels (new Panamax 8,000 to 10,000 TEUs vessels), which may increase to 11,000 and 13,000 TEUs.

As a result, major regional ports made and continue to make significant investments into infrastructure and equipment, to accommodate the new Panamax size vessels and to remain competitive. The largest vessel to call at the Port of Port-of-Spain (PPOS) is 295 meters, with a draft of 12 meters and a container capacity of 5000 TEUs.

Unfortunately, the infrastructure and channel cannot accommodate the longer and deeper draft vessels. Infrastructure and draft limitations also restrict the ability of PATT to accommodate large cruise ships transiting the region. The quay wall is already at maximum depth, except for berth 7, which can be deepened from 12 metres to 14 meters. However, berth 7 is only 197 meters long and PPOS will need to accommodate vessels with lengths over 300 meters.

Priority has been given to the construction of berths 9 & 10 to accommodate larger vessels. They will provide alternate berths as necessary to facilitate upgrade development at the other berths without significant interruption of vessel movement.

Most equipment at the Port is obsolete and negatively affects the ability to handle vessels transiting with high cargo (transhipment and domestic) volumes, at competitive productivity levels, limiting revenue generation potential.

The PPOS contributes over 75 per cent of the total revenue of PATT and is apportioned the highest share of the overhead cost being approximately 60 per cent of PATT’s overheads, which depletes its operating margin.

The highest revenue stream is earned from the Cargo Handling business. The gross profit margin of PPOS has been fairly consistent at 20 per cent over the period except for FY 2020 which experienced a sharp decline of 14 per cent in revenue earned as a result of six per cent decrease in vessel calls and 13 per cent decrease in cargo throughput.

POSINCO is responsible for the real estate, equipment, plant, buildings and other non-real property, rights and obligations of the PATT, as well as the Caricom Wharves regional cargo activities and cruise shipping business in Port-of-Spain. POSINCO plays a key role in facilitating business due to its responsibility in maintaining, upgrading and expanding infrastructure, . The limitations faced by PPOS relative to infrastructure, are as a result of POSINCO not having required Capex which is requested annually via PSIP funding from the government. POSINCO is 100 per cent reliant on PSIP for capital projects.POSINCO contributes 23 per cent of the total revenue of PATT and is allocated its respective share of overheads, with the highest stream of revenue being earned from vessel charges.

Decrease in operating expenditure reflected in FY 2019 and FY 2020, was directly associated with the cost associated with towage charges being transferred to the account of the shipping lines with the exception of cruise ships which are treated as per tariff charges. Operations at POSCA include cruise shipping, cargo handling operations of bonded cargo and locally assigned cargo. Presently the POSCA’s lands and real estate are vested in PATT. THA is responsible for construction, maintenance, repair, storage and warehousing facilities.

POSCA is a very small revenue earner, contributing around two per cent to the total revenue of PATT. The main revenue stream for POSCA emanates from cruise ship operations, which accounts for over 65 per cent of its revenue .The downward trend in revenue from FY 2019 reflects losses experienced in Cruise Shipping operations. The expected outcome of the EOI would be to obtain information from the private sector in order to clarify the scope of the potential PPP Project for the Port, and identify opportunities for private participation/inclusion in the port sector .

The goal of the GoRTT in increasing private participation is to establish a more competitive & financially sustainable port system. Specific benefits are: Improved level of governance in PPOS’ operations; Improved port activities and operational efficiency which can be positively leveraged to improve the ease of doing business; Positive revenues via dividends, concessions and/or lease payments and taxes;and stimulation of the local manufacturing sector.

Behind the proposed 2023 electricity rate hike

2024, 08/22

T&TEC workers staged protests outside of the San Fernando office on Cipero Street in March.

Erik Lavoie, a recent intern with Guardian Media Ltd, has written several recent articles exposing weaknesses in the process by which the Regulated Industries Commission (RIC) recommended rate increases for the Trinidad and Tobago Electricity Commission (T&TEC), one of several important players in the Trinidad and Tobago (T&T) electricity market and its regulation.

Here, he seeks to explain the issues behind the fact that the RIC’s recommendation for an increase in home electricity bills of between 15 per cent and 64 per cent has been stuck with a Cabinet sub committee for over ten months. The RIC also recommended that commercial and industrial customers pay higher rates.

The Trinidad and Tobago Electricity Commission (T&TEC) is the state-owned sole electric utility provider for both islands (Trinidad and Tobago). T&TEC is not a vertically integrated utility (VIU), although close to being one.

While Transmission and Distribution (T&D) is completely owned and operated by T&TEC, generation is predominantly provided by independent power producers (IPPs) that engage in Power Purchase Agreements (PPAs) with T&TEC. Some of these IPPs have partial (51 per cent) or full (100 per cent) T&TEC or Government of the Republic of Trinidad and Tobago (GORTT) stakeholder ownership. The only exception to this is generation operations on the island of Tobago, where T&TEC owns an 64-megawatt (MW) power plant (natural gas, simple cycle), which provides electricity for the entire island of Tobago, and a backup 22 MW plant (diesel) on Tobago as well. T&T’s electricity generation, in watt hours, is more than 99 per cent sourced from plants that use natural gas. The less than 1 per cent is a mix of solar and diesel. T&D system losses are around 9 per cent.

The three IPPs generating electricity for the larger island of Trinidad are PowerGen, Trinity Power Limited (TPL), and Trinidad Generation Unlimited (TGU), with T&TEC engaging in four different PPAs: PowerGen: T&TEC has a 51 per cent stake in PowerGen (49 per cent private-owned).

PowerGen operates two different power plants: (200 MW, combined cycle), (624 MW, simple cycle).

T&TEC has two PPAs with PowerGen, one for each of the power plants.

Trinity Power Ltd (TPL): TPL is 100 per cent private owned (Contour Global). TPL operates one power plant: [210 MW, simple cycle]. T&TEC has one PPA with TPL.

Trinidad Generation Unlimited (TGU): TGU used to be owned by AES Corporation, but now is 100 per cent GORTT owned as of 2013. TGU operates one power plant: (720 MW, combined cycle). T&TEC has one PPA with TPL.

Generation costs are primarily of an operational expenditure (Opex) nature and are considered uncontrollable for the most part. T&TEC faces two types of Opex generation costs: fuel costs and conversion costs. T&TEC faces these two types of distinct costs because the electricity market works in a “tolling” format, where T&TEC is responsible for purchasing the fuel for the IPPs at no cost to the IPPs. This is T&TEC’s fuel cost. At the same time, T&TEC must pay the IPPs for converting T&TEC’s purchased fuel into electricity. This is T&TEC’s conversion cost.

Fuel Cost—Understanding what the National Gas Company (NGC) does:

The NGC is the state-owned sole distributor and pipeline operator for domestic natural gas consumption. The NGC purchases natural gas from wellhead producers like bpTT and sells the gas downstream. The NGC has multiple large customers, one of which is T&TEC. The NGC practices price discrimination, offering the lowest gas price to T&TEC ($1.74/MMBTU in 2024, escalating 3 per cent per annum) relative to other large customers. The gas price charged by NGC to its customers is determined by the GORTT.

Conversion Cost—Understanding the PPAs:

Information about the structure of the three PowerGen and TPL PPAs are publicly available (information as of 2006, assuming nothing has changed since), while information about the TGU PPA is not publicly available (TGU’s financial statements suggest capacity costs are treated as a lease which consist of 99 per cent of total costs faced by T&TEC and adjusted by US CPI). The PowerGen and TPL PPAs contain three formulas, with the sum of these formulas making up the monthly cost incurred per PPA by T&TEC. These formulas are Capacity Cost, Energy Cost, and Excess Cost.

Capacity Cost Formula:

The capacity cost formula is what is used to pay the IPPs for the available maximum contracted capacity for use on-demand by T&TEC, measured in kilowatts (kW). In other words, this portion is a take-or-pay agreement that does not reflect the actual kilowatt-hour (kWh) electricity demand as a function of PPA. Capacity costs allow the plant to recover fixed costs and the cost of building the plant.

The capacity formula takes in the following variables: contracted capacity (kW), a base capacity rate ($/kW), the change in the United States (US) Consumer Price Index (CPI), and a weight for the US CPI influence (PowerGen is 1, TPL is 0.275). Capacity costs consist of about 97-98 per cent of total conversion costs (excluding excess formula costs) for T&TEC. When analysing conversion costs, most attention should be given to changes in capacity costs.

Energy Cost Formula:

The energy cost formula is what is used to pay the IPPs for the actual kWh generation of the power plants. This is intended to allow the plant to recover the variable costs of operation. Energy costs consist of about 2-3 per cent of total conversion costs (excluding excess formula costs) for T&TEC.

Excess Cost Formula:

The excess cost formula is what T&TEC pays when T&TEC needs capacity from the IPPs that is beyond what is obligated by the IPPs in the PPAs. I will not attribute a percentage of PPA costs originating from the excess cost formula as this type of formula is activated irregularly.

T&TEC’s financial situation and tariffs:

T&TEC consistently sustains annual deficits of around $1 billion per year (US$150 million). While Opex has steadily increased over the years, T&TEC’s electricity rates charged to consumers have not increased since 2009, marking a 15- year period without a rate review.

This is directly in violation of Section 48 of the RIC Act, a law which states that rate reviews should be conducted every five years. To this day, the public does not know the true reason why rate reviews were not conducted/finalised in 2011, 2016, and 2021.

The politicisation of electricity rate hikes and/or the lack of experience needed to conduct rate reviews or ability of regulated utilities to publish proper business plans could be responsible for the lack of a rate review.

As a result, T&TEC has negative equity, meaning liabilities exceed assets. T&TEC relies on subventions from the Government to finance its loan obligations. (T&TEC’s unconsolidated financial statement for 2021) T&T has one of the lowest retail electricity rates in the world.

The median household pays around $US 0.05 per kWh (retail) for electricity. Other Caribbean nations, like Jamaica, have residential retail rates close to $US 0.40 per kWh. The low residential cost in T&T is due to the use of domestically sourced natural gas for electricity generation and is further supported by three different layers of indirect and direct subsidies:

- 1) NGC selling gas to T&TEC at a loss/break-even: If the NGC were to prioritise its profits like most publicly traded and non-government owned companies do, it would sell natural gas to T&TEC at a minimum rate of around $US 2.50 to 3.00 per MMBTU. The NGC does not do this, selling gas to T&TEC at $US 1.74 per MMBTU. This is an indirect subsidy that lowers the retail cost of electricity for all of T&TEC’s consumers.

- 2) T&TEC running billion-dollar deficits: An electric utility should be able to recover its cost of providing service and receive a rate of return on its Regulatory Asset Base (RAB). T&TEC’s losses are an indirect subsidy that lowers the retail cost of electricity for all of T&TEC’s consumers.

- 3) Cross-subsidisation of residential consumers: Cost-of-service studies are undertaken to economically allocate costs per user category (industrial, consumer, commercial) based on the ‘impactor pays’ principle. T&TEC’s rates do not reflect the individual cost-of-services for each of the consumer categories, as industrial and commercial consumers pay a proportion of costs that is more than what the cost-of-service study would prescribe, and residential consumers pay a proportion of costs that is less than what the cost-of-service study would prescribe. This is a subsidy for residential consumers.

The RIC’s role

The Regulated Industries Commission (RIC) is the regulator of natural monopolies in T&T, analogous to what a Public Utilities Commission (PUC) does in the US. In T&T, other greater regulatory mandates that would be regulated by the Federal Energy Regulatory Commission (FERC) in the US are normally handled by the Ministry of Energy and Energy Industries (MEEI), Ministry of Public Utilities (MPU), or T&TEC itself.

One responsibility the RIC has is setting General Electricity Standards (GES) and Overall Electricity Standards (OES). These are metrics that regulated monopolies such as T&TEC, must exceed or meet the RIC’s prescribed target (metrics like billing punctuality, complaint responsiveness, etc.). Regulated monopolies pay a fine if they do not meet these standards.

The RIC is also tasked with regulating the IPPs that fall under the schedule of the RIC Act. The RIC Act only includes PowerGen and TPL in its schedule. TGU is not regulated by the RIC.

The RIC’s primary task is facilitating the rate reviews for the regulated monopolies. We will substitute T&TEC for the term “regulated monopoly” to emphasise T&TEC as the regulated monopoly of interest. The appropriate rate review process is summarized as follows:

• Either (1) A 5-year period has passed, requiring the RIC to pursue a rate review for T&TEC, per section 48 of the RIC Act, or (2) T&TEC submits a “written notice” (unclear what this notice constitutes) indicating that “extraordinary circumstances” require a fundamental rate review before the 5-year period has passed, per section 49 of the RIC Act;

• The RIC works on developing the framework and approach towards conducting a rate review in a document called “Framework & Approach: Second Regulatory Control Period Electricity Transmission & Distribution Sector”. The RIC has historically favoured the building blocks method, which utilises incentive-based regulation;

• (This step might precede and/or follow step 2): The RIC publishes a document titled “Information Requirements: Business Plan 2021 – 2026 T&TEC”, outlining the information and justifications it expects to see contained T&TEC’s business plan to be sent to the RIC;

• The RIC and T&TEC briefly consult following the publishing of the “Information Requirements” document by the RIC;

• T&TEC works on and refines their Draft Business Plan to be sent to the RIC;

• Upon receipt of T&TEC’s Draft Business Plan, the RIC scrutinises it and then provides guidance to T&TEC, allowing T&TEC to correct/adjust any problems the RIC noted in the Draft Business Plan. The RIC may also publish technical papers to support the upcoming determination.

• T&TEC works on and submits a Final Business Plan to the RIC. RIC may continue to publish technical papers to support the upcoming determination.

• The RIC begins writing the Draft Determination, where it should scrutinise T&TEC’s requested values for the individual components that make up Opex, Capital Expenditure (Capex), Depreciation, Weighted Average Cost of Capital (WACC), etc;

• Upon completion of the Draft Determination, the RIC consults with stakeholders (including T&TEC) and the public for 2 months. Stakeholders can provide written comments to the draft determination, or attend public hearings arranged by the RIC.

• Written comments are responded to in aggregate within a single document published by the RIC, justifying their decision to either accept or reject each of the recommendations made by stakeholders in their written comments.

• The RIC publishes its final determination after taking into consideration the comments made by stakeholders and the public. The RIC’s final determination is also sent to the Ministry of Public Utilities (MPU) for review.

• MPU sends the RIC’s recommendation to Cabinet, which takes the decision on whether to “accept” or “reject” the RIC’s final determination. Cabinet consults with both the RIC and T&TEC to make their decision.

Accept and reject are in quotes, since what Cabinet does is decide to implement the rates recommended by the RIC or not. If Cabinet “accepts” and implements the rates, T&TEC reserves the right to price at or below the RIC’s approved retail rates, and the process is successfully concluded. If Cabinet “rejects” the RIC’s recommendation, the situation becomes a bit unclear. Cabinet can, of course, send the final determination back to the RIC, indicating that the RIC must “redo their work”.

This whole process should take place in a time span of one to two years.

Unfortunately, the RIC has not been consistent in delivering on rate reviews every five years (mandated by section 48 of the RIC Act). The Water and Sewerage Authority of T&T (WASA), a state-owned monopoly provider of water and sewerage services in T&T, has not undergone a rate review for 31 years, compared to a lack of a rate review for 15 years for T&TEC.

The RIC has claimed that either these regulated monopolies (T&TEC, WASA, etc) do not submit a business plan when asked, or the business plans submitted by these monopolies are either incomplete or insufficient to such an extent where a proper rate review cannot be conducted.

Given the obscurity around the whole process, its is unclear whether the RIC’s claims are correct or not.

There are also questions whether the recent rate review was conducted using the ideal and expected process highlighted above.