Suriname

Columbus joins state player Staatsolie

PARAMARIBO, Oct 4 (Reuters)

Suriname’s SOC signs production-sharing deal with Columbus as the London-listed junior eyes fast-track development of the onshore Weg Naar Zee block. Staatsolie Maatschappij Suriname signed a production-sharing agreement for the onshore Weg Naar Zee (WNZ) block with Britain-based oil and gas exploration company Columbus Energy Resources.

Highlights

- Onshore block with a discovered resource of 24mmbbl (STOIIP) in a proven hydrocarbon province.

- Large block (900km²) with exploration potential.

- No signature bonus or upfront consideration.

- Company can control timing of appraisal/development work.

- Phase 1 Exploration Period (3 years) consists of G&G studies and 2 Extended Well Tests.

- Suitable for application of Enhanced Oil Recovery techniques used by Columbus in Trinidad.

- Complimentary to existing operations and on-strategy.

The 30-year agreement would carry out a “minimum exploration program” in the 90,100-hectare block during the first seven years.

Executive Chairman Leo Koot said,

“For Columbus, WNZ is a low-cost, low-risk entry into a block with an estimated 24 million barrels in a proven hydrocarbon province.

The Company is delighted to have signed the Production Sharing Contract with Staatsolie for the Weg Naar Zee block, onshore Suriname (‘WNZ’). Staatsolie have been seeking partners with experience in onshore field developments with secondary and tertiary recovery experience to commercialise the discovered oil resources. Columbus’s experience in Trinidad will perfectly complement the existing Staatsolie oilfield production operation experience in Suriname.

We would like to thank Staatsolie for their support and assistance in signing the PSC and look forward to working with Staatsolie to make WNZ a success for both parties. For Columbus, WNZ is a low cost, low risk entry into a block with an estimated 24mmbbl STOIIP in a proven hydrocarbon province, close to existing infrastructure. Provided the results from the extended well tests are as expected, the Company intends to fast track the development of the WNZ oil discoveries.’

Source: Columbus Energy

OIL DISCOVERIES IN NEIGHBORING GUYANA LED TO OPTIMISM IN SURINAME THAT THE SAME FORMATIONS CONTINUE ACROSS THE BORDER INTO THE FORMER DUTCH COLONY, WITH A POPULATION UNDER 600,000.

Staatsolie has already signed production-sharing agreements with Exxon Mobil Corp and Tullow Oil Plc.

Suriname has not made any commercially viable offshore oil discoveries so far. Exxon discovered over 6 billion barrels of oil in Guyana and expects to start producing in December.

( Ank Kuipers, Angus Berwick, Paul Simao.)

Apache Corp.

Apache spuds wildcat off Suriname

US player gets under way at well on block close to ExxonMobil’s Turbot discovery in Guyana

(Bloomberg) – The independent energy company explores for, develops, and produces natural gas, crude oil, and natural gas liquids. Apache operates worldwide.

Steven Keenan, the senior vice president of worldwide exploration leading one of Apache ’s most-important exploration ventures has resigned. The company’s shares and bonds tumbled, and the cost to insure against default surged. The high-profile departure may fuel concerns about the search for crude in Suriname, adjacent to an Exxon Mobil Corp. discovery, one of the world’s biggest finds.

The resignation is not connected to Suriname. The drill bit is still above the first target zone in the Suriname well.

Apache may provide an update on the progress of its exploratory efforts across the 1.4-million-acre offshore tract known as Block 58 as soon as Oct. 30, when the Houston-based company is scheduled to report third-quarter results.

The shares fell as much as 11% for the biggest intraday drop since January 2016. The stock was down 5.6% to $21.93 at 1:34 p.m.

The cost to insure against an Apache default jumped to the highest since August 2016. Five-year credit-default swaps tied to the company were among the worst performers in the investment-grade CDS market, widening to as much as 31 basis points on a day when the overall market tightened by 1.2 basis points. The yield on Apache’s most actively traded bond, 4.375% notes that mature in 2028, widened by 21 basis points, according to Trace, and were among the most actively traded notes in the investment-grade market.

Recently, Bank of America Merrill Lynch touted the Suriname prospect as potentially game-changing for Apache.

It “has potential to reset the investment case,” Merrill Lynch’s veteran oil-industry analyst Doug Leggate said. On the strength of that thesis, Leggate upgraded his rating on the stock and said a single good well could translate into a $6-a-share benefit for Apache.

Keenan was hand-picked by Apache’s then-Chief Executive Officer Steve Farris in 2014 to replicate the dramatic discoveries he oversaw for EOG Resources Inc. in the Eagle Ford shale basin in South Texas. After he joined Apache, the company announced its Alpine High discovery in a little-drilled corner of the Permian Basin in West Texas. At the time, the company said the play held 3 billion barrels of crude and 75 trillion cubic feet of gas. Apache’s stock has underperformed rival producers since it first touted the Alpine find, which is far richer in gas than more valuable crude.

Apache- highlights (Link- www.apachecorp.com )

- Reported third-quarter production of 451,000 barrels of oil equivalent (BOE) per day. Adjusted production, which excludes Egypt noncontrolling interest and tax barrels, was 391,000 BOE per day, exceeding upper-end guidance of 383,000 BOE per day;

- Achieved U.S. production of 266,000 BOE per day, which exceeds upper-end guidance of 260,000 BOE per day; international adjusted production was 125,000 BOE per day, slightly ahead of guidance;

- Invested $590 million in upstream capital; remain on track for $2.4 billion for the year;

- Nearing first production from two new high-volume North Sea wells;

- Drilling first well in Block 58 offshore Suriname; expected to reach total depth in November; and

- Announced organizational initiatives targeting operational efficiencies and annual cost savings of at least $150 million.

HOUSTON, Oct. 30, 2019 – Apache Corporation (NYSE, Nasdaq: APA) today announced its financial and operational results for the third quarter of 2019.

- Apache reported a quarterly loss of $170 million or $0.45 per diluted common share for the third quarter of 2019. These results include a number of items outside of core earnings that are typically excluded by the investment community in their published earnings estimates. When adjusted for items that impact the comparability of results, Apache reported a third-quarter loss of $108 million or $0.29 per share.

- Adjusted earnings were generally in line with expectations except for the impact of increased depreciation, depletion and amortization costs. This was primarily associated with a reduction in Alpine High reserves due to deteriorating natural gas liquids (NGL) and gas prices. Upstream oil and gas capital investment was $590 million in the third quarter.

- Net cash provided by operating activities in the quarter was $635 million and adjusted EBITDAX was $905 million.

“During the third quarter, adjusted production exceeded guidance while capital expenditures remained on pace with our full-year guidance of $2.4 billion,” said Apache CEO and President John Christmann. “In September, we began drilling the first of three committed wells in Block 58 offshore Suriname. We are also nearing first production from two wells in the North Sea, which should establish strong production momentum as we enter 2020.”

Third-Quarter Operational Summary

Highlights from the company’s principal areas include:

- Permian – Production averaged 254,000 BOE per day during the quarter and Apache operated an average of 10 rigs and drilled and completed 47 gross-operated wells. In the Permian Basin, our oil production in the second half of the year has been modestly impacted by some unplanned downtime events and completion schedule delays. As a result, the company is now projecting fourth-quarter Permian oil volumes of approximately 100,000 barrels per day.

- Production at Alpine High averaged 76,000 BOE per day for the quarter and the company averaged five rigs and one frac crew and placed 15 wells on production. Volumes previously deferred due to low Waha prices were returned to production during August and September.

- As a result of continued weakness in gas and NGL pricing, the company has reduced Alpine High drilling activity to two rigs and has chosen to defer some fourth-quarter completions into 2020. These changes, combined with a reduced production outlook for a recent multiwell pad, has resulted in a 5% decrease in fourth-quarter Alpine High production guidance.

- Egypt – Apache averaged seven rigs during the quarter and drilled and completed 14 gross-operated wells. Adjusted production in Egypt, which excludes noncontrolling interest and the impact of tax barrels, averaged 72,000 BOE per day, up slightly from the second quarter. The company drilled multiple successful exploration wells during the quarter that have positive implications for future development inventory.

- North Sea – Apache averaged three rigs during the quarter and produced 54,000 BOE per day, which reflects an anticipated decrease related to seasonal platform maintenance. The company expects to bring its first well at Storr online in November and its second well at Garten online around year-end. The Garten well encountered approximately 1,200 feet of pay, which significantly exceeded the company’s pre-drill estimates.

- Suriname – Apache is currently drilling the Maka Central #1 well and expects to reach total depth in November at approximately 6,325 meters as measured from the deck of the drillship. The well is designed to test multiple targets and is located roughly seven miles from the Suriname / Guyana maritime border. Apache also exercised its option to drill two additional wells in Suriname Block 58 with the Noble Sam Croft drillship.

Organizational and Cost Saving Initiatives

“Apache has historically employed a decentralized, region-focused approach to operations. In recent years, we have centralized certain key activities, and today we see an opportunity to capture greater efficiencies by taking further steps in that direction,” continued Christmann. “To accomplish this, we have initiated a comprehensive redesign of our organizational structure and operations that will position us to be competitive for the long term. This process, which began in late summer, should be largely completed by the end of the first quarter 2020. We are targeting at least $150 million of combined annual savings and look forward to updating you on our progress in the future.”

“Our primary objectives are to deliver competitive, risk-adjusted returns with a long-term moderate pace of growth and improve our free cash flow yield to levels consistent with other mature industrial sectors. As we look to 2020, based on current strip prices, we anticipate our upstream capital budget will be 10% to 20% below this year’s program of $2.4 billion. This will enable us to generate organic free cash flow that covers the current dividend and puts us on pace to fund a multiyear debt reduction program, while also delivering modest year-over-year oil production growth. We look forward to sharing the details of our 2020 capital plan in February,” concluded Christmann.

Apache Corporation is an independent oil and gas exploration and production company with operations in the United States, Egypt and the United Kingdom. Apache posts announcements, operational updates, investor information and copies of all press releases on its website,www.apachecorp.com

US$25M from USAID for Caribbean SME

Nov 03, 2019 United States Agency for International Development (USAID) entered into a partnership valued at US$25 Million or JMD$3.4 Billion with The National Commercial Bank Jamaica Limited (NCB).

The NCB/USAID agreement marks the first-ever regional loan portfolio guarantee. Along with Jamaican entities, financing is also available to Small and Medium Size Enterprises (SMEs) in Barbados, The Bahamas, Dominican Republic, Grenada, Guyana, St. Kitts and Nevis, St. Lucia and the 22 -island archipelago of Trinidad and Tobago.

The guarantee agreement allows lending to registered SMEs with under 250 employees and gross annual sales below US$20 Million. The partnership agreement was signed on October 31 at the NCB.

Funding will also be available for investments in machinery, equipment, facilities, business expansion and small-scale irrigation system projects.

The Loan Fund under the agreement is available to SMEs who are customers of NCB and other banks and offers interest rates as low as 7% for JMD loans or 5% for USD loans with repayment terms up to 15 years.

Loan amounts are available up to JMD690 Million (US$5 Million) with guarantee amounts of up to JMD$345 Million (US$2.5 Million).

Through the initiative, known as the Development Credit Authority or “DCA” Loan Portfolio Guarantee Agreement, assistance will be made possible to SMEs via access to funding for Energy Saving and Clean Energy Production Projects.

“SMEs are engines of job creation and are essential to strengthening our economy. Therefore, NCB has recognized that it is our responsibility to ensure we help create the optimal environment for such a critical sector.”

The Minister of Industry, Commerce, Agriculture and Fisheries lauded NCB and USAID for the initiative which he said had a massive potential to stimulate SME growth and subsequent national and regional economic development. “I served for six years as Minister of Finance and one of the goals I set out was to bring the economy back to single-digit interest rates, so I am happy today to see that an initiative of this magnitude has achieved that. We are going in the right direction”

The initiative also provides targeted support for the energy sector, with an even more narrowed focus on renewable energy in Jamaica and the Caribbean to help build resilience and economic self-sustainability.

John Barsa, Assistant Administrator, Latin America & the Caribbean Bureau, USAID highlighted that the timing of the partnership is perfect as we currently navigate the 2019 Atlantic Hurricane Season.

“The recent events that crippled our neighbours in The Bahamas, is a harsh reminder to Jamaica, the United States and the rest of the region of how devastating natural disasters can be. While these events are unavoidable, what we can do, is put resilient measures in place to lessen the impact on our resources. The US has identified that one of the major concerns within Jamaica and the region is to advance the resiliency and security of the energy sector.”

The partnership with NCB began through a pledge of additional support for energy security, following a meeting last year with CARICOM leaders..

“This partnership is a testament to what can happen when the public and private sector come together to address common issues. This partnership will allow NCB, via the loan portfolio guarantee, to reduce [their] risk exposure and enable them to utilize their resources to increase lending for energy investments in Jamaica and the Caribbean,” Barsa concluded.

Global Ports Holding at Antigua Cruise Port

Cruise port operator Global Ports Holding (GPH) is set to begin cruise port operations in Antigua following the signing of a concession agreement with the government.

In February, GPH agreed the 30-year concession for cruise port operations in Antigua on an exclusive basis.

“The addition of cruise port operations in Antigua and Bahamas to GPH’s portfolio augurs well for the future of the cruise industry in the Caribbean. The GPH team looks forward to working with all stakeholders to continue to build on the potential of Antigua and the Caribbean,” Emre Sayın, G P H Chief Executive Officer commented.

GPH and partners will finance completion of the new pier that will be capable of berthing the largest, 5,000+ passenger vessels in the industry. GPH and Royal Caribbean Cruises partnered to invest in the completion of the pier, allowing the port to handle Oasis-class ships

Antigua hosted around 800,000 cruise passengers in 2018. The addition of Antigua Cruise Port to GPH’s portfolio is expected to increase GPH’s total passenger volumes for 2020 to close to 13 million.

GPH aims to improve the port and design new retail facilities, with an expected initial investment in the first 12 months of operation of USD 45-50 million. Balance will be spent to improve the surrounding port area by the last quarter of 2021.

GPH is committed to working with local authorities and stakeholders to improve the guest experience at the port.

Antigua is potentially the highlight of Southern and Deep Southern cruise itineraries, as well as transatlantic routes. Serving mainly as a transit port, Antigua and Barbuda also has the opportunity for some turnaround cruise operations, predominantly for European cruise brands.

Barbuda is going green.

Beach-filled Barbuda is going green after the devastation in 2017,

United Arab Emirates is joining with the CARICOM Development Fund and other partners to build a resilient green power system for Barbuda.

The UAE-Caribbean Renewable Energy Fund will work with CDF, along with Antigua and Barbuda’s government and the government of New Zealand to restore power to the island paradise.

“After the devastation caused by Hurricane Irma in Barbuda, we are not only trying to restore electricity to the island — we will work to rebuild it even better,” said Sultan Al Shami, Assistant Minister of Foreign Affairs for the United Arab Emirates. “Providing the island with a solar power plant will solve its energy crisis, provide clean, environmentally friendly energy, and improve the living conditions of islanders who will operate and maintain the new solar power plant to help reduce the impact of climate change.”

The agreement will see the disbursement of $5.7 million from the UAE to support Antigua and Barbuda through the largest renewable energy initiative of its kind in the Caribbean region.

The Government of Antigua and Barbuda also invested $1 million through the CDF, and the Government of New Zealand donated $500,000 to aid in funding the project and building a hybrid solar-diesel power station equipped with hurricane-resilient battery storage.

“This project will be a core component of the efforts by our government to transform Barbuda into possibly the first truly climate-resilient community in our region and doing this within a sustainable energy framework,” said Robin Yearwood, Minister of Public Utilities, Civil Aviation, Transport and Energy for Antigua. “This will also serve as a model for other Caribbean small-island developing states.”

The project aims to build a modern, climate-resilient, safe, reliable and sustainable supply of electrical power for Barbuda in the wake of Hurricane Irma, which destroyed 95 percent of the island on Sept. 6, 2017, and forced all 1,800 residents to be evacuated to Antigua.

“As part of the second funding cycle of the UAE-CREF, this energy efficient and multi-faceted project on the island of Barbuda exemplifies the level of collaboration needed to ensure that renewable energy alternatives are spread far and wide to areas or states that can gain maximum benefit.,” said Mohammed Al Suwaidi, Director General of the Abu Dhabi Fund for Development. “Caribbean island nations are rich in sustainable resources that are used to produce energy. ADFD is delighted to work alongside its distinguished partners to bring clean energy alternatives to the area and support the Government of Antigua and Barbuda in translating its national priorities into tangible realities.”

The plant will displace an estimated 260,000 liters of diesel fuel per year, saving the government of Antigua and Barbuda $320,000 and offsetting 690 metric tons of carbon dioxide annually.

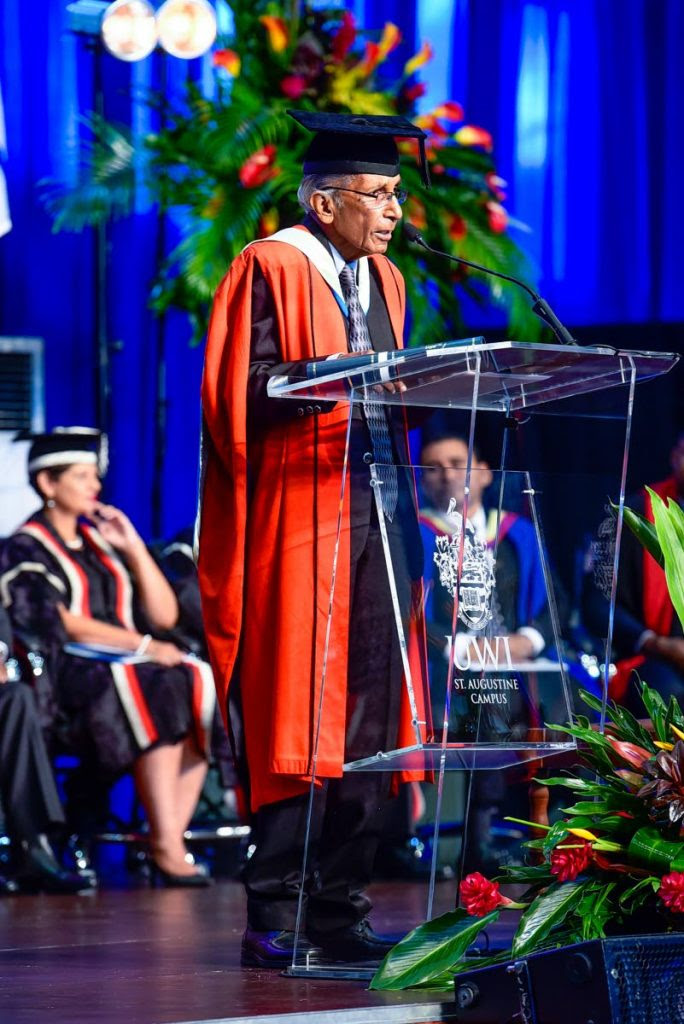

UWI honours Prof Ramkissoon

Professor Emeritus Harold Ramkissoon delivers his acceptance speech after receiving an honorary doctorate from the UWI at their Faculty of Science & Technology – Food & Agriculture graduation ceremony. Photo – Elliot Francois

PROF Harold Ramkissoon expressed concern over climate change as he received an honorary doctorate from the University of the West Indies.

Ramkissoon, a distinguished lecturer, researcher, scholar and mathematician, received the honour in front of hundreds of graduates, during the first of two ceremonies held at UWI, St Augustine.

He urged the graduates – echoing the words university chancellor Robert Bermudez, who spoke before him – to tackle the most dire issues which “threaten the existence of mankind,” such as climate change.

“I am a deeply worried man,” he said. “We must move with a greater sense of urgency to restore the good health of our planet or suffer greater, dire consequences.”

Of his doctorate, he said, tongue in cheek, “I am particularly pleased, Mr Chancellor, that this honour is bestowed on me pre-, rather than post.”

Giving the context of his long academic journey, Ramkissoon said it began under difficult circumstances, as he was born the first of 11 children in the countryside of Tabaquite. He said he knew at an early age that education was the way out.

“But that was easier said than done,” he explained. “There were major challenges. The odds were simple against me. Secondary education was then not free and tertiary education, very costly.

“However, with determination, resilience, a strong work ethic and a sense of focus, I went on to Presentation San Fernando, and then to Mona campus (UWI)…”

Ramkissoon went on to obtain a PhD in Canada before returning to the Caribbean.

The degree represents just one of many honours Ramkissoon has received for his many academic publications and other works. He was awarded the first Caricom Science Award (jointly with Jamaican Dr Raymond Wright), the Chaconia Gold national award, the Academic Gold Medal of Simon Bolivar University in Venezuela, as well as the key to the city of Havana, Cuba.

The conferral of the honorary doctorate, he said, “confirms that to some measure my objective has been achieved.

“Today, I am pleased to say that here in the Caribbean, we have a strong, vibrant science culture.”

Graduation ceremonies at the St Augustine Campus continued, with a morning and evening ceremony on two days. Former Central Bank governor Ewart Williams is set to receive an honorary doctorate during this afternoon’s ceremony.

A number of valedictorians will deliver farewell messages on behalf of the graduating classes.

The Open Campus and Cave Hill Campus graduation ceremonies were held on October 12 and 19, respectively. Mona Campus will host ceremonies next Friday and Saturday.

Andrew Gioannetti 25 october

Professor Emeritus Harold Ramkissoon of Trinidad and Tobago for his work as a Mathematician and his contribution to the development of Science and Technology in the Caribbean and beyond – DSc

From a young age, Professor Emeritus Harold Ramkissoon fostered a love for Math, first completing a BSc Honours in mathematics from The UWI Mona Campus then going on to receive an MSc at the University of Toronto and a PhD at the University of Calgary in the area of applied mathematics. Professor Ramkissoon’s work focuses on the practical, real-world application of mathematical concepts in the study of flows and fluids—particularly Non-Newtonian Fluids, Stability Analysis, Micro polar Fluids and Flow Past Spheroids.

Professor Ramkissoon has dedicated his life to instilling a deeper understanding of science and mathematics through research and teaching, and has lobbied for the harnessing of science and technology in the service of the Caribbean and its people. Through his career, first as a Lecturer and then Professor Emeritus, he has shared his passion with upcoming generations and in the process, became the first West Indian to be given a Personal Chair in Mathematics at The UWI.

For his contribution to the region, he has received numerous awards including the first CARICOM Science Award, the Chaconia Gold Medal (the second highest national award of Trinidad and Tobago) and the Academic Gold Medal of the Simon Bolivar University in Venezuela. He continues to play a role in the development of science and technology in the region and the world through his service in a number of capacities. These include his contribution as President of the Caribbean Academy of Science, President of the Caribbean Scientific Community, and Executive Member of both the Association of Academy of Sciences of the World (IAP) and the Inter American Network of Academies of Sciences (IANAS).

Professor Ramkissoon also served as an Independent Senator in the Parliament of the Republic of Trinidad and Tobago from 2010-2013, where he used his platform to positively influence policies in his country and the Caribbean, especially on issues of social consequence. Throughout his political and academic careers, he has taken a deeply human approach to his work, while maintaining his devotion to the fields of Mathematics and Science.

Trinidad

Senator advises mass transit system

Independent Senator Deoroop Teemal told the Senate in the budget debate that road network projects of the Government will not alleviate traffic congestion and the country needs a mass transit system.

Trinidad and Tobago has a relatively well-developed highway and main road system. Vehicle ownership of approximately 500 vehicles per 1,000 people is among the highest in the world.

Despite all of this highly capital-intensive highway and road network construction, it is most likely that traffic congestion would continue to be an issue and a problem, particularly in urban areas.

Policies should encourage high vehicle occupancy and development of a mass transit system. Announcement of 300 buses for the PTSC was a very noble objective.

“It is the responsibility of any country to ensure a good mass transit system that brings affordable means of transport to the citizens of a country. And it is good that we are looking to increase the bus fleet to PTSC.”

In March 2016 consultants from the Inter-American Development Bank did a high-level strategic analysis of mass transit alternatives to implement in the East-West Corridor and north-south transit corridors. They concluded that a BRT PBR (bus rapid transit and priority bus route system) is the best bus-based mass transit alternative.

In January 2017 the recommendations were received by the Association of Professional Engineers of TT (APETT) transport committee, which recommended immediate implementation of the system. In May 2017 APETT submitted a document to the Planning Ministry with a conceptual design of a mass transit system for the East-West Corridor, later submitted to the Works and Transport Ministry. In conjunction with the increase in the number of buses, the implementation of the mass transit system should be examined.

Transport will become less problematical with digitalisation.

-

- More people can work from home.

- School and university courses can be online.

- With security compromised, citizens may benefit from decentralisation.

- Diesel cars are being phased out.

Advancing the HSSE Transition

Every citizen must get on board and make the change to save the environment, the MINISTER of Public Utilities told AmchamTT’s 23rd annual Health and Safety, Security and the Environment (HSSE) conference.

He questioned business executives on the energy efficiency of their buildings, whether their employees are encouraged to conserve energy in their day-to-day activities, and whether they have done an energy audit to determine how they can better optimise their energy resources.

“These are the steps that help shift public perception and attitudes in the right direction. And that is not just the government’s job, but the responsibility of everyone who resides and works in this country.

“… citizens of a country must move from being spectators to being actively involved in moving the country forward. You have the responsibility not just of participating in that movement, but of leading it.”

Congratulating AmchamTT on the role it continues to play in establishing best practices for health and safety, he said the government, in its national development strategy (Vision 2030), established five overarching development themes to focus and guide a transformational agenda. This is to specifically place the environment at the centre of social and economic development, in keeping with a number of sustainable development goals outlined by the U N.

On responsible energy consumption and production, he said: “..there is much more to the programme than .. LED bulbs. The programme entails: energy audits for government buildings, a reduction in energy usage for schools accompanied by the requisite retrofitting, the use of more energy-efficient vehicles, the installation of solar water heaters in all new HDC housing developments, and the eventual conversion of our major city centres into smart cities.”

There will be collaborations with the private sector, academia and international organisations to explore different applications of hydrogen in the local economy.

It is envisaged that this programme, when fully implemented, will result in energy cost savings of $1.2 billion over the next five years, while creating over 4,000 jobs and reducing carbon dioxide emissions by six million tons. That last figure is expected to increase to almost 18 million tons by 2030.”

He discussed the importance of water conservation and the government’s Workplace Reuse and Recycling Programme geared towards changing the way organisations manage their waste by making it easy for them to recycle.

96 private-sector entities, including 11 commercial banks and 41 insurance companies, have signed on to the programme and he encouraged everyone to follow.

President of AmchamTT Patricia Ghany reviewed trends and topics to help the organisation further advance the HSSE transition that will be useful to various organisations.

Statistics from the Occupational Safety and Health Agency (OSHA), show a 33 per cent reduction in fatalities in 2017-2018 as compared to 2016-2017. A 54 per cent increase in non-critical accidents over the same period, which is cause for concern.

AmchamTT is concerned about progress that OSHA has made compared to equivalent OSHA bodies in other countries.

“The OSHA Act was passed in 2004 and amended in 2006. It is based largely on the UK’s Health and Safety At Work Act 1974.”

The legislation is outdated.

“It seems we have become stagnated.

“We all conduct business differently, our processes have changed, our job designs have changed, and so too should our legislation. Amcham TT is calling on Government to pay attention to this very important regulatory organisation. Safeguarding the lives of those working in TT is of utmost importance.”

Senior management and the C-suite (comprising CEOs, COOs, CFOs and chairmen of public and private sector companies) should own and understand the key issues involved in HSSE, make decisions on how to communicate, promote and champion health and safety, allocate enough resources to manage risks, set targets and design clear goals and objectives, and maintain monthly reports to review with an aim to decisive and immediate action on health and safety performance.

On disaster resiliency, she asked: “Where is the disaster management resiliency plan, and is it working? Our nation needs a comprehensive disaster resiliency plan that integrates climate-change considerations into priority sectors to allow for the appropriate interventions.”

In this light an MOU was signed between Amcham TT for the private sector’s Alliance Resilient Societies (ARISE) project initiative, with the UN office for Disaster Risk Reduction (UNDRR), an initiative that is expected to raise awareness and share knowledge to co-ordinate an efficient disaster risk reduction proposal for TT.

Ghany applauded the banning of styrofoam and reducing the cost of energy-saving bulbs, but everyone has a part to play with regard to climate change.

Dr. Philip Mshelbila, CEO of title sponsor Atlantic, also addressed participants on the increasing demand for cleaner energy alternatives and how his company can play a part in this area.

Guyana grass is greener

Alexander Ramessar, MEnvSci, HBSc, B.Eng. Mech.

... it is my opinion that the oil industry in Guyana will come to an end within a relatively short time frame. I am an Environmental Scientist educated at the University of Guyana and the University of Toronto with over a decade of Environmental Management experience in Ontario, Canada. The following are my personal views and opinions based on my investigation when making the decision to purchase an electric vehicle.

There is general consensus that the supply of oil will be plentiful in the future but also that there will be many challenges on the demand side. The Center for Strategic and International Studies says that the total oil market is close to 100 million barrels per day with transportation taking 56% or approximately 56 million barrels per day and industry in second place with about 28% of the share. As seen with Guyana, existing technology is capable of finding reserves in the many billions of barrels which can keep this oil market going with a business as usual scenario. However, there is ongoing pressure from grassroots organisations to force decision makers to implement policy choices to meet emission reduction targets to tackle the global climate crisis. As a result society will increasingly adopt new green technology such as EVs which will weaken the demand for oil.

Electric Vehicles are rapidly replacing Internal Combustion Engine (ICE) vehicles. The sales of ICE vehicles are going down because consumers are realising that EVs are superior. People are buying an EV as their next car or waiting for the right choice to arrive. In their report Global EV Outlook 2019, the International Energy Agency (IEA) says that in 2018, the global electric car fleet exceeded 5.1 million, up two million from 2017 and almost doubling the number of new electric car sales. EV adoption will accelerate even more when the ban of ICE vehicles by more than 10 countries which include France and the United Kingdom and 20 large cities around the world such as Mexico City start to take effect by 2030.

When the number of EVs on the road starts to reduce global oil demand by about 2 million barrels of oil per day, an oil glut will manifest itself. Production will have to be reduced in order to maintain prices but this will not be sufficient to stop the decline. The IEA says that by 2030 the number of EVs in the world could be more than 250 million which would cut demand for about 2.5 million barrels of oil per day. High cost oil extraction operations will become stressed at first followed by operations in places like Guyana. We saw an example of this when in 2014 oil was over produced by 1.5 million barrels per day and oil prices plunged from $100 (US) a barrel to around $40 (US) a barrel. The solution at the time was to cut production to stabilise the price. However when the oil glut is caused by EVs, cutting oil production will not be enough as each subsequent year more EVs will be on the market and it will become progressively worse for oil producers as oil demand continues to diminish. Oil producers will need to sell more and more to make up for the loss of revenue. This action will increase the supply and lower the price, hence the beginning of the cycle which will eventually render oil a near useless commodity and simultaneously put Guyana’s oil industry in jeopardy.

An emerging set of dynamics on the demand side will determine the life of the oil industry in Guyana but the situation will not be ideal. If oil producers can cooperate to keep oil prices high throughout the decline in oil demand then the life of the industry will be prolonged. However many analysts believe that it will be difficult to achieve harmony on this issue. Also in Guyana’s favour is the lower production cost which should keep the industry afloat for a bit longer. In addition, there will remain a large number of ICE vehicles in the developing world such that oil demand for transportation will not disappear but will trend to zero over time. Nonetheless, EVs will start to arrive in the developing world as well. If demand for oil from industry which is 28% of market share rises, then the effect may also be a delay in the decline of the oil and gas industry. However industry is already under pressure to adopt green technology to tackle the global climate crisis so the 28% is likely to decrease.

I think that the evidence is clear that the oil and gas industry will be under high stress by 2030 and there will be negative ripple effects that may be felt in Guyana right away. I believe that it would be wise for Guyana to have an action plan which can adjust accordingly for a future with no more oil revenue which may come in as little as 10 years. In my view, there should be no long term investments in oil and gas infrastructure. Guyana should invest in self-sustaining projects that can achieve dramatic improvements in the living standards of Guyanese. A great place to start is with the, ‘The Green State Development Strategy: Vision 2040’, which should be implemented aggressively before oil becomes obsolete.

(BBC -Bristol could become the UK’s first city to ban diesel vehicles from entering parts of the city centre in a bid to cut air pollution. The city suffers from poor air quality, particularly from high levels of nitrogen dioxide (NO2))

Eastern Caribbean Embarks on Strategy Towards a Blue-Green Economy

Voices from the Global South podcast, IPS.

Jewel Fraser learns how micro, small and medium enterprises hold the key for building economies that are resilient to the impacts of climate change.

SAINT AUGUSTINE, Trinidad and Tobago, Sep 3 2019 (IPS)

Micro, small and medium enterprises as well as niche markets and experiences such as bee tourism may well hold the key for the Organisation of Eastern Caribbean States as countries of that sub-region, known as the OECS, ramp up efforts to build economies that are resilient to the impacts of climate change.

To help reach their goal, the OECS is working with the Trinidad-based Caribbean Natural Resources Institute, CANARI, on a green-blue economy strategy and action plan; the launch of the plan was announced in July. The Caribbean green-blue economy strategy and action plan will make the most of the sub- region’s strengths, harnessing these to create economies that are environmentally friendly and more socially equitable. Credit: Elizabeth Eames Roebling/IPS

Senior Technical Officer at CANARI, Alexander Girvan, tells Inter Press Service (IPS) the green-blue economy strategy and action plan will make the most of the sub- region’s strengths, harnessing these to create economies that are environmentally friendly and at the same time more socially equitable. Our Caribbean Correspondent Jewel Fraser asks Girvan to tell us just how will the OECS-CANARI action plan make this happen.

Bourbon Rhode

Search efforts for the missing Bourbon Rhode crew have been unsuccessful following a potential distress flare spotted in the area. According to Bourbon, search operations continue but they are entering a new phase of active monitoring. The offshore vessel sank on September 26 after finding itself near the eye of a category 4 hurricane “Lorenzo.” Before sinking, the crew sent a distress signal in which it said the vessel had developed a water ingress. There were 14 people aboard at the time of the accident. The vessel had been on its way from Las Palmas to Guyana.

Three crew members were rescued, four were confirmed dead and their bodies recovered, while seven crew members still remain missing.

Three survivors from the Bourbon Rhode arrived in Fort de France on Sunday, October 6 on board the French Navy frigate Ventôse.

French vessel operator Bourbon said on Saturday, October 12 that, following the report of a possible distress flare on the night of Sunday 6 to Monday October 7, the CROSS French West Indies-Guyana (Regional Operational Centre for Surveillance and Rescue) had dispatched four ships to search the area, with the support of an overflight by the US Coast Guards aircraft.

Over the past week, search has been intense and extensive to try to detect a sign after on the one hand, the report of this potential distress flare and on the other hand, the satellite photo obtained from the European Maritime Safety Agency (EMSA). These new searches have unfortunately been unsuccessful, Bourbon reported.

As a whole, search operations have not found any trace of life or life rafts for more than 10 days now despite measures of exceptional magnitude, Bourbon said.

Search and rescue operations have been going on for 16 days.

As decided by the CROSS, search operations are not suspended and won’t stop on a specific date. But they are entering a new phase of active monitoring during which the CROSS will mobilize all vessel transiting in the area to implement an adapted monitoring, according to Bourbon.

“Our priority is to provide families and relatives of the Bourbon Rhode crew with all possible support under these tragic circumstances. On behalf of all the employees and in particular all those who work tirelessly within the Bourbon crisis cells, I want to reiterate how much our thoughts are with the families of the missing seafarers,” Bourbon CEO Gaël Bodénès said.

The Bahamas

BPC and Seadrill are working to agree critical drilling plan dates for Bahamas well.

Bahamas Petroleum Company (BPC) has made progress toward drilling an initial exploration well in The Bahamas during 2020. The company is working on finalizing a long-form rig contract with Seadrill and preparing for drilling.

Seadrill’s West Neptune drillship – : Seadrill

BPC announced a proposed a £7 million (c. $8.5 million) open offer at a price of 2 pence per share to enable all existing shareholders to participate in the company’s next fundraising.

The company developed a drilling schedule to target an initial exploration well in 1H 2020.

Following an announcement in August 2019 it had entered into a framework agreement with Seadrill, setting the terms for the potential use of Seadrill’s drilling rig for the first exploration well in the Bahamas in 2020, BPC said it had sent notice to Seadrill nominating rig delivery date (and expected well spud) for late 1Q 2020.

The framework agreement required BPC, on or before October 11, 2019, to notify Seadrill that it wishes to “Go-Firm”. Given the greater certainty and progress made in relation to funding, the company has thus now advised Seadrill that it wishes to “Go-Firm” on the provision of a drilling rig.

Accordingly, the company has notified Seadrill of its desire to secure a rig for an intended spud date in late 1Q 2020. Over the coming weeks the company and Seadrill will be working to finalize the rig contract, confirm the rig selection, and agree the critical drilling plan dates.

BPC noted that the governing document in relation to provision of the drill rig would be the rig contract, which remains to be entered into and is subject to Seadrill’s board approval process for contract commitment.

Simon Potter, Chief Executive Officer of Bahamas Petroleum Company, said: “I am pleased to advise shareholders of continued progress toward drilling an initial exploration well in The Bahamas during 2020. A farm-out remains our preferred funding option, and constructive discussions continue. At the same time, we are moving forward with additional components of a balanced funding strategy, so that we can deliver on drilling regardless of the outcome of these discussions. This includes giving our existing shareholders the first opportunity to participate in our next fundraising via an open offer.

“We have also signed the subscription agreement for our previously announced convertible note facility, and we have received a number of other funding proposals. Given the progress made in relation to our funding strategy, we have notified Seadrill of our desire to receive a rig in late 1Q 2020, and we are now working collaboratively with Seadrill on both finalizing the long-form rig contract and preparing for drilling.”

BPC expects to raise $20 million

The company has a clear and unambiguous obligation under its licenses to drill an initial exploration well in The Bahamas during 2020. Discharge of this obligation will then allow the company to enter the next exploration period, running for a further three years, and in the event of commerciality seek a 30 year production lease that would allow for a commercial development of any discovered reserves.

Over the last six months, the company has revised its drilling costs estimates to incorporate contracted pricing from service and equipment providers, and also to reflect a well design and drilling philosophy that will comply with the requirements of the company’s licenses whilst at the same time enable a full evaluation of the target structures. Accordingly, the company currently estimates a cost to meet its drilling objectives in the range of $20 million – $25 million.

The company currently has sufficient cash available to meet general working capital needs through to 2H 2020. Over and above these general working capital needs, it is necessary for the company to develop a degree of certainty as to the availability and timing of funding for drilling costs, primarily in order to enable the company to nominate, confirm and proceed to a definitive contract for the rig, and also to ensure other aspects required to start drilling, such as the procurement of long-lead items, provisioning and ancillary equipment, are available.

However, the bulk of the company’s expected cash outflows, and thus the company’s actual need for funding availability (outside of working capital), will generally only arise shortly before and during the course of drilling (thus late Q1 2020 and beyond).

It is in this context that that board has determined to proceed, in the first instance, with a proposed £7 million (approximately $8.5 million) open offer to existing shareholders at 2 pence per share with any entitlements not taken up by qualifying shareholders sought to be placed with investors.

At the same time, the company has entered into a subscription agreement for the previously announced and approved £10.25 million (approximately $12.5 million) conditional convertible loan facility.

In aggregate, therefore, the open offer and the conditional convertible notes would raise an aggregate amount of approximately $21 million, which exceeds the lower-end estimates for the total well-cost.

Still seeking partner

As previously announced, the company’s farm-out process continues, with a number of parties engaged in ongoing discussions, due diligence and/or commercial interaction. It remains the company’s preference to secure funding through this structure, albeit the company’s attitude to potential farm-in terms in ongoing negotiations will necessarily reflect the funding status of the initial well at the time a farm-out is successfully concluded (if at all).

To the extent that a farm-out is successfully concluded on terms acceptable to the company, the amount of capital available to the company would materially increase, and as previously noted could be materially additive to the funds raised through the open offer and conditional convertible notes.

Such funding could be applied towards all or a considerable portion of the costs in respect of the intended drilling, or alternatively proceeds from any farm-out could be applied to a broader work program than the current single well the company intends to drill in 2020.

(With regional energy security guaranteed by Exxonmobil Guyana,The Bahamas may be wise to focus on imports, after the Dorian disaster, instead of risking environmental degradation)