Bahamas Petroleum

Update ahead of drilling

Bahamas Petroleum Company, the oil and gas exploration company with significant prospective resources in licences in The Commonwealth of The Bahamas, has provided details of several important in-country developments, as the Company continues its coordinated work effort toward drilling of an exploration well in The Bahamas in 2020.

Highlights

- Process initiated seeking to provide Bahamians with an opportunity to invest in the Company’s nationally significant project, via creation of a Bahamian-domiciled mutual fund that will exclusively hold BPC shares

- Environmental Authorisation process and data collection proceeding to schedule, consistent with drilling timetable; Environmental Baseline Survey commenced, following timely receipt of necessary permits from Government of The Bahamas

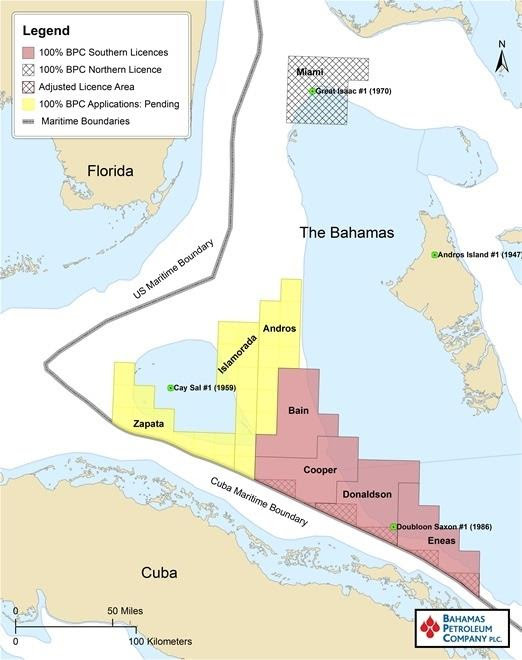

Bahamas Petroleum’s exploration licences and applications

Bahamian Mutual Fund Initiative

With BPC’s sole focus being to explore for, and thereafter commercialise, Bahamian hydrocarbon resources, it has long been the Company’s stated objective to ensure, if possible, that the people of the Bahamas have an equal opportunity to participate in the ownership of the project, through the ability to invest in the Company.

Following implementation by the Government of The Bahamas of updated operations, safety and environmental laws and regulations (in 2016) specific to the offshore industry, their clarification of the Company’s licence term (in February 2019) and the consequent progress being made by the Company towards commencing exploration drilling in late Q1 2020, the Company considers that it is now an opportune time to revisit the matter of providing local Bahamian investors with a means to invest in the Company.

In conjunction with its advisors, the Company will be seeking to develop and implement a Bahamas-domiciled mutual fund investment vehicle with the sole mandate of owning BPC shares. Thus it is intended that through this mutual fund, Bahamians will be able to invest in the Company and thus in the exploration and potential development of hydrocarbon resources in The Bahamas. To this end the Company has engaged Leno Corporate Services Limited (“Leno”), a Bahamian investment services and fund management firm, to act as its adviser for this purpose.

The Company expects that, following a further process of consultation with Leno and various administrators in The Bahamas, details of the proposed mutual fund, including the terms, how investors’ interests in BPC would be reflected, eligibility for, anticipated timeframe and manner of subscription, will be confirmed in the coming weeks.

Environmental Authorisation Progress Update

A. Background

In 2012, in accordance with the requirements under then prevailing laws in The Bahamas, BPC completed an Environmental Impact Assessment (“EIA”), which was reviewed and accepted on behalf of the Government of The Bahamas (“Government”) by the Bahamas Environment, Science and Technology (“BEST”) Commission. Since then, the EIA document has been a public domain document open to public scrutiny and comment (via both the BEST and BPC websites). The Company has also undertaken extensive community consultation and made numerous public presentations to communities, stakeholders and public bodies throughout The Bahamas (New Providence and the Family Islands).

In 2016, new laws and regulations pertaining solely to the petroleum industry and more specifically to offshore exploration and production were adopted in The Bahamas, with the effect of modernising and strengthening legislative oversight in areas of safety and environmental compliance. These new laws and regulations introduced for the first time in The Bahamas an entirely new concept of Environmental Authorisation (“EA”), as a required mandatory step before commencement of drilling activities. In April 2018, BPC submitted an EA application in compliance with this new regulatory requirement. BPC’s EA application included, inter alia, an updated EIA (to that already accepted in 2012) and an Environmental Management Plan (“EMP”).

B. EA – Current Status

BPC’s EA application, including the updated EIA and EMP, was reviewed by energy consultants Black & Veatch (“B&V”) as external consultant advisers to BEST Commission. B&V’s methodology and mode of analysis consisted primarily of a “gap analysis”, in which B&V sought to identify any gaps in the EA documentation provided by BPC against any applicable laws, regulations and applied international standards.

Subsequently, the Company appointed Acorn International (“Acorn”), a leading international environmental adviser, to work with the Company and liaise with B&V / BEST Commission in finalising the relevant EA documentation so as to address any gaps as identified by B&V.

A major part of the work being undertaken by Acorn pertains to incorporating into the EA documentation detailed data unique and specific to the actual rig, that will undertake the planned drilling activity. Substantial elements of the document submitted in April 2018 contained, of necessity, only generalised data of a ‘hypothetical rig’ that could be utilised to carry out the drilling operations. However, now that BPC is working with Seadrill, specific data from the rig that will be mobilised to the field is available and can be included as part of the application update. This data includes, in particular, technical details, equipment lists, standard operating procedures, and response plans specific to that rig.

All parties are working collaboratively on the task of concluding all work necessary for the finalisation of the EA in early Q1 2020, so as to meet a timeline developed in conjunction with BEST and Government directive, and consistent with drilling activities scheduled to commence as planned in late Q1 2020.

C. Environmental Baseline Survey

A substantive piece of work to be undertaken as part of the EA process is an Environmental Baseline Survey (“EBS”). This survey will determine the environmental baseline conditions (biological, chemical, physical) at the proposed drilling location by providing detailed measures of the currently prevailing environmental conditions, and against which any potential effects of future operations can be detected and measured. This includes collection of samples (at a range of water depths and distances from the proposed drill site) to characterise macroinfauna, document physicochemical conditions and characterise the water column. A photographic survey will be used to further characterise the seafloor substrates and associated biological communities as well as identifying any potential archaeological artefacts. This is over and above the work previously completed (and included in the 2018 EA application) that described the surface and shallow subsurface conditions of BPC’s Southern Licence areas using detailed 3-D exploration seismic interpretation, multibeam bathymetry, and hull-mounted sub-bottom profiler.

In conjunction with a marine environmental consulting firm, CSA Ocean Sciences (“CSA”), a Terms of Reference for this work was developed, and submitted to BEST. Following a detailed review and consultation with their appointed external consultants, the Terms of Reference were approved by BEST, and two specific permits issued:

-

- the first (issued by the BEST Commission on behalf of the Ministry of Environment and Housing) allowing for the collection of necessary samples; and

- the second (issued by the Ministry of Agriculture) allowing for the export of those samples for analysis purposes.

In the coming weeks CSA will now proceed to deploy the necessary vessel to site to commence the physical work of sample collection, and thereafter proceed to the detailed biological, chemical and physical analysis of samples collected, as required and agreed with the Government.

D. Response Plan – Advanced Simulation Modelling

A significant component of the EMP is having a proactive and effective response plan to any potential incidents. Responding quickly and efficiently requires knowledge of where to respond to and which habitats to prioritise. To this end, since 2012, BPC has created and maintained environmental sensitivity maps of coastal area habitats, fauna and flora and sensitive receptors to allow the Company, any stakeholders or any Government agencies to have a better understanding and appreciation of coastal life and usage, thereby helping direct an effective response (if required).

A key piece of additional knowledge required for finalising BPC’s response plan is predicted fate and behaviour of particles or matter in the sea depending on prevailing currents, tides, water depth, surface conditions and weather data. Such predictions are derived based on advanced simulation models using many years of historic data. BPC completed such a simulation as part of its EIA in 2012, but, as agreed with Government, is seeking to supplement this previous study now with new and repeated studies.

To this end, BPC has engaged leading industry consultant RPS ASA Group to undertake this study, making use of RPS’ proprietary state-of-the-art three-dimensional modelling tools. Completion of this work is expected in early Q1 2020, when the outputs of this study will be incorporated into the EMP as appropriate.

Simon Potter, Chief Executive Officer of Bahamas Petroleum Company, said:

‘As we continue to move toward drilling of an initial exploration well in The Bahamas in 2020, I am pleased to advise of two important in-country developments.

First, BPC is seeking to assess the petroleum resources of The Bahamas, which in the event of a successful exploration campaign and thereafter development, could be transformational to the economy of The Bahamas, by adding significantly to the nation’s revenue base over and above that from more traditional sources. In 2016, the then Government established a framework in law for the establishment of a Sovereign Wealth Fund, for the purpose of harnessing such revenues. Beyond this, however, we at BPC have long believed that Bahamians should be able to invest in the Company, and, in this way, have a ‘direct ownership’ interest in their own national resource. We have therefore initiated a process seeking to create a Bahamas-domiciled mutual fund, which, in the event of its establishment, would provide a vehicle whereby individual Bahamians will have that opportunity to invest in BPC’s project of potentially national significance. We expect to be able to provide full details of this initiative in the coming weeks.

Second, the timely receipt of requisite approvals from the Government means we have been able to commence a critical piece of preparatory work ahead of drilling activities: the collection of a comprehensive range of samples necessary to demonstrate the current ambient conditions at the proposed drill site. This will allow a direct assessment of any potential impact from our planned activities, noting that those activities by their very nature will be for a short, temporary duration, close to the international maritime border with Cuba, in a location which is an active marine thoroughfare serving both the existing petroleum facilities in The Bahamas as well as the entire region. We remain on track to see drilling commence on schedule.’

Source: Bahamas Petroleum

Bahamas Petroleum continues progress toward first exploration well in 2020

Bahamas Petroleum Company, the oil and gas exploration company with significant prospective resources in licences in The Commonwealth of The Bahamas, has provided details of continued progress toward drilling its first exploration well in The Bahamas in 2020.

Highlights

- Master Service Agreement entered into with BakerHughes GE

- Purchase of wellheads and 36″ conductor casing for delivery in March 2020, consistent with schedule for spudding the well

In August 2019, Following extensive technical discussions and mutual due diligence, BPC received proposals (including pricing) for a range of well-related equipment, including wellheads and tubulars, for the intended drilling 2020 campaign. At that time, and as previously announced, BPC issued a notice of award to BakerHughes GE for provision of that equipment, as a precursor step to a detailed contract as is customary in the industry.

As contemplated, and following a further period of negotiation and collaborative work, BPC has now entered into a Master Services Agreement (‘MSA’) with BakerHughes GE for the provision of specified equipment.

Further, and pursuant to the MSA entered into, BPC has now also placed a first purchase order with BakerHughes GE, for a wellhead set, a contingency well head set, and 36″ conductor casing. The wellhead set is being manufactured to order for BPC’s intended well, and delivery is expected in a timeframe consistent with the current drilling schedule.

Simon Potter, Chief Executive Officer of Bahamas Petroleum Company, said:

‘Finalising the Master Service Agreement with BakerHughes GE has enabled us to reach a long-awaited and significant milestone for our company: placing an order for the wellheads that have been made to order for our exploration well in The Bahamas. In ordering these high value, critical path, long-lead items, along with the other multiple work streams ongoing, management is taking demonstrative steps to ensure we remain on track for drilling to commence as per our previously announced drill schedule.‘

Source: Bahamas Petroleum

BPC seals the deal with Baker Hughes

Bahamas Petroleum Company (BPC) has finalized an agreement with Baker Hughes for the provision of equipment for its first exploration well in The Bahamas in 2020. However, the company is still working to secure the financing and finalize a rig contract with Seadrill.

In August 2019, following extensive technical discussions and mutual due diligence, BPC received proposals (including pricing) for a range of well-related equipment, including wellheads and tubulars, for the intended drilling 2020 campaign.

At that time, BPC issued a notice of award to Baker Hughes for provision of that equipment, as a precursor step to a detailed contract as is customary in the industry.

BPC informed on that, following a further period of negotiation and collaborative work, BPC had entered into a Master Services Agreement (MSA) with Baker Hughes for the provision of specified equipment.

Further, and pursuant to the MSA entered into, BPC has now also placed a first purchase order with Baker Hughes, for a wellhead set, a contingency well head set, and 36″ conductor casing.

The wellhead set is being manufactured to order for BPC’s intended well, and delivery is expected in a timeframe consistent with the current drilling schedule.

Simon Potter, Chief Executive Officer of Bahamas Petroleum Company, said: “Finalizing the Master Service Agreement with Baker Hughes has enabled us to reach a long-awaited and significant milestone for our company: placing an order for the wellheads that have been made to order for our exploration well in The Bahamas. In ordering these high value, critical path, long-lead items, along with the other multiple work streams ongoing, management is taking demonstrative steps to ensure we remain on track for drilling to commence as per our previously announced drill schedule.”

One-well obligation & funding

Earlier this year, BPC received an extension for its offshore blocks until the end of 2020. With the extension came an obligation to drill an exploration well at its 4 commercially co-joined offshore licenses Bain, Cooper, Donaldson, and Eneas sitting at water depths of around 500 meters (1500 feet).

BPC has been unsuccessfully trying to secure a farm-in partner for its offshore acreage, to help fund the obligatory exploration well. This has driven the company to seek alternative options.

In September 2019, BPC reduced its previous estimate for the well cost from the range of $25 million to $30 million to $20 million to $25 million.

In October 2019, BPC announced a proposed a £7 million open offer at a price of 2 pence per share to enable all existing shareholders to participate in the company’s next fundraising.

In addition, the company said it had developed a drilling schedule to target an initial exploration well in the first half of 2020.

Following a framework agreement with Seadrill from August, BPC in October said it had sent notice to Seadrill nominating rig delivery date, and expected well spud, for late 1Q 2020. The rig contract remains to be entered into and is subject to Seadrill’s board approval process for contract commitment.

BPC also said in October that the farm-out agreement was the company’s preferred funding option, with a number of parties engaged in ongoing discussions.

The company stated at the time: “It remains the company’s preference to secure funding through this structure, albeit the company’s attitude to potential farm-in terms in ongoing negotiations will necessarily reflect the funding status of the initial well at the time a farm-out is successfully concluded (if at all).”

With drilling plans on track, BPC to enable local investment

Bahamas Petroleum Company (BPC) has decided to develop and implement a Bahamas-based mutual investment fund with the aim of owning BPC shares as the company continues its work effort toward drilling of an exploration well in The Bahamas in 2020.

BPC said that it was an opportune time to revisit the matter of providing local Bahamian investors with a means to invest in the company.

The rationale behind it was the fact that the company made progress towards the beginning of exploration drilling in the Bahamas in the late first quarter of 2020.

BPC added Bahamians would be able to invest in the company through this mutual fund and thus in the exploration and potential development of hydrocarbon resources in The Bahamas.

To this end, the company engaged Leno Corporate Services Limited, Bahamian investment services and fund management firm, to act as its adviser for this purpose.

Simon Potter, Chief Executive Officer of Bahamas Petroleum Company, said: “In 2016, the then Government established a framework in law for the establishment of a Sovereign Wealth Fund, for the purpose of harnessing such revenues. Beyond this, however, we at BPC have long believed that Bahamians should be able to invest in the Company, and, in this way, have a ‘direct ownership’ interest in their own national resource. We have therefore initiated a process seeking to create a Bahamas-domiciled mutual fund, which, in the event of its establishment, would provide a vehicle whereby individual Bahamians will have that opportunity to invest in BPC’s project of potentially national significance.”

The company added that a substantive piece of work to be undertaken as part of the environmental authorization (EA) process is an environmental baseline survey (EBS).

This survey will determine the environmental baseline conditions at the proposed drilling location by providing detailed measures of the currently prevailing environmental conditions, and against which any potential effects of future operations can be detected and measured.

This includes a collection of samples, documentation of physicochemical conditions, and characterize the water column. A photographic survey will be used to further characterise the seafloor substrates and associated biological communities as well as identifying any potential archaeological artifacts.

New laws adopted in the country in 2016 introduced for the first time in The Bahamas an entirely new concept of Environmental Authorisation (EA), as a required mandatory step before beginning of drilling activities. In April 2018, BPC submitted an Environmental Authorisation application, which included an Environmental Management Plan.

The company is now working to conclude all work necessary for the finalization of the EA in early 1Q 2020, so as to meet a timeline developed in conjunction with BEST and Government directive, and consistent with drilling activities scheduled to start in late Q1 2020.

Response plan for potential incidents

According to the company, a significant component of the environmental management plan is having a proactive and effective response plan for any potential incidents.

A key piece of additional knowledge required for finalizing BPC’s response plan is predicted fate and behavior of particles or matter in the sea depending on prevailing currents, tides, water depth, surface conditions, and weather data which are derived from simulation models.

BPC completed such a simulation as part of its EIA in 2012, but, as agreed with the Government of the Bahamas, it is seeking to supplement this previous study now with new and repeated studies.

In that regard, BPC engaged RPS ASA Group to undertake this study, making use of RPS’ proprietary three-dimensional modeling tools. Completion of this work is expected in the early first quarter of 2020 when the outputs of this study will be incorporated into the EMP as appropriate.

Meanwhile, BPC entered into a framework agreement with drilling contractor Seadrill back in August 2019, setting the terms for the potential use of Seadrill’s drilling rig for its first exploration well in the Bahamas in 2020. The company stated in October that it was working on finalizing a long-form rig contract with Seadrill and preparing for drilling.

The company also finalized an agreement with Baker Hughes for the provision of equipment for its first Bahamas well.

Suriname

Apache tests wildcat intervals

US independent preparing to deepen well at Maka Central-1 prospect

Apache to drill deeper at Suriname well

Oil and gas company Apache Corporation has decided to drill even deeper at its first exploratory well in Block 58 offshore Suriname.

Noble Sam Croft drillship; Source: Noble Corporation

In an update Apache said that drilling operations on the Maka Central-1 well started in late September with an expected drill time of 30 to 60 days. This is Apache’s first of three committed wells in Block 58 offshore Suriname.

The company said that, upon reaching a depth of approximately 6,200 meters, it had elected to conduct various testing activities in two distinct Upper Cretaceous play types.

Following the completion of these tests, the company will set casing, make equipment modifications to the rig, and resume drilling in mid-December to evaluate a third play type in the Cretaceous.

The new target depth of the well is approximately 6,900 meters. Following the drilling operations, further testing and evaluation will be conducted as appropriate.

Back in October, Apache said it had expected to reach total depth in November at approximately 6,325 meters. The company also in October exercised two of three option wells for the 2014-built Noble Sam Croft drillship, extending the contract to March 2020.

The drillship is operating in Suriname with one option well remaining. According to an estimate by Bassoe Offshore, the dayrate for the Noble Sam Croft contract with Apache is $170,000. The rig’s previous dayrate with W&T in the Gulf of Mexico was estimated at $160,000.

Source: Offshore Energy Today Staff

Apache plunges on ‘incredibly thin’ well update

HOUSTON (Bloomberg) – Apache Corp. tumbled after the company’s update on a closely watched exploratory oil well off the coast of Suriname offered little indication as to whether it will be commercially viable.

Tests were carried out on the Maka-1 well after it reached a depth of about 6,200 meters (20,300 feet), the Houston-based company said Monday. After those tests are completed, the company will resume drilling in mid-December “to evaluate a third play type” at a new target depth of about 6,900 meters.

But going for a third zone could indicate that the first two were unsuccessful, said Leo Mariani, an analyst at KeyBanc Capital Markets. “There’s no color,” he said of the update. “Typically we’d have something like, ‘We found oil’ or ‘We found gas.’ It was just incredibly thin.”

Apache shares and bonds dropped on the news. The company’s stock pared earlier losses but continued to trade down 13% to $19.45 a share at 11:35 a.m. in New York, the lowest since 2001. Five-year senior credit-default-swaps widened 21 basis points, the most since April 2016, according to data provider CMA.

Apache’s Suriname exploration is adjacent to an Exxon Mobil Corp. discovery that’s one of the world’s biggest finds in years, but investors have been anxious about the viability of the project ever since the company’s high-profile geologist unexpectedly resigned in October. That sank Apache shares and bonds, though they later recovered after Chief Executive Officer John Christmann said on a conference call that the company hadn’t “seen anything that would be unexpected” from its exploratory well.

Still, some analysts have been skeptical. In October, Morgan Stanley’s Devin McDermott put the odds that Maka-1 will show no commercial oil resource or a low gas discovery at 80%.

The next update on the Maka-1 well may not come until January, Mizuho’s Paul Sankey said in a note to clients. “This is hardly the champagne cork moment that was potentially at play here,” he said, “but then again nor is this firmly a dry hole.”

Disclosure that drilling, which began in September, will continue to a deeper zone is cause for even greater concern, in our view. Suggesting it was confident about its portfolio even without Suriname implies less confidence in the project.

Unlike most offshore exploration ventures, Apache holds 100% of the working interest on Block 58 offshore Suriname, where the Maka-1 well is being drilled. Hess Corp., for example, has just a 30% interest in the Stabroek Block offshore Guyana. That leaves Apache and its shareholders more exposed to the long-awaited results.

Maka-1 is “among the most anticipated wells in the world,” analysts at Tudor, Pickering, Holt & Co. said in a note Monday. “While we appreciate the desire to test multiple play concepts given promotion of the vast potential of this block, releasing the first update without any color on the results of the first two tests will not be taken well by the market.”

Columbus Energy

The oil and gas producer and explorer with operations onshore Trinidad, has announced the signature of a Production Sharing Contract with Staatsolie for the Weg Naar Zee Block, onshore Suriname.

St. Lucia

IMF Staff Concluding Statement of the 2019 Article IV Mission

November 18, 2019

A Concluding Statement describes the preliminary findings of IMF staff at the end of an official staff visit (or ‘mission’), in most cases to a member country. Missions are undertaken as part of regular (usually annual) consultations under Article IV of the IMF’s Articles of Agreement, in the context of a request to use IMF resources (borrow from the IMF), as part of discussions of staff monitored programs, or as part of other staff monitoring of economic developments.

The authorities have consented to the publication of this statement. The views expressed in this statement are those of the IMF staff and do not necessarily represent the views of the IMF’s Executive Board. Based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF Executive Board for discussion and decision.

An IMF mission visited St. Lucia during October 29-November 8, 2019, for the annual Article IV consultation discussions on economic developments and macroeconomic policies. At the end of the mission, Mr. Ding, mission chief for St. Lucia, issued the following statement.

St. Lucia’s near-term growth prospects are favorable, supported by large infrastructure investments and robust tourist inflows. However, longer-term growth continues to be impeded by high public debt, lingering vulnerabilities in the financial system, and structural impediments to private investment. To enhance economic resilience in an increasingly precarious external environment, near-term policies should focus on rebuilding fiscal space and addressing risks to financial stability. Concerted efforts are also needed to mobilize climate financing and unlock potential growth through supply-side reforms.

- Robust tourism inflows have sustained economic activity despite delays in public infrastructure investment. Growth picked up in 2019 with record growth in tourism activities more than offsetting a contraction in construction. Preliminary information also shows a further improvement in the current account. Unemployment has declined somewhat but remains high at 18 percent. Inflation remains subdued.

- Near-term growth prospects are favorable, albeit with downside risks. The commencement of large public infrastructure projects by the year-end is expected to substantially boost growth in 2020-22. The major upgrade of the international airport and the road network will help address capacity constraints and has the potential to catalyze a more durable expansion of the tourism sector and related activities. Downside risks to the outlook include a deeper-than-expected slowdown in major source markets for tourism, energy price shocks, disruptions to global financial markets, and loss of correspondent bank relationships. St. Lucia’s high vulnerability to natural disasters constitutes an ever-present risk to both growth and the fiscal outlook.

- Fiscal policies should be geared toward rebuilding policy space and ensuring public debt converges to the ECCU target of 60 percent of GDP by 2030. Prudent fiscal policies in recent years, supported by revenues from the citizenship-by-investment program (CIP), have helped to stabilize public debt as a share of GDP. The primary fiscal position is projected to remain broadly balanced in 2019, notwithstanding additional salary expenditures and retroactive wage increases from the recently concluded wage negotiations. However, the still elevated level of public debt, currently at 65 percent of GDP, leaves the government with little fiscal space to react to shocks. The debt-financed infrastructure investments, despite being on concessional terms with long-run repayment largely covered by new revenue measures, will move public debt further away from the regional target in the absence of fiscal consolidation efforts. The need to invest in climate resilience and the uncertainty over future CIP revenues pose additional challenges to public finances.

- The government’s near-term focus should be on revenue-enhancing measures and investing to build resilience against climate related shocks. The fiscal measures that have been announced—including reforms to the personal income tax and the residential property tax—are expected to be budget neutral in the near term. This underscores the need to restrain current spending (particularly the public wage bill) and to mobilize additional revenues from the hotel accommodation fee, introducing a carbon tax, and reducing the scope of VAT exemptions. Since some of these measures will likely be regressive, they should be introduced in parallel with targeted transfers that offset the impact of these measures on poor households. Concerted efforts are also needed to mobilize donor grants to fund investments in climate resilience. Any over-performance of the CIP, or of other revenue sources, should be directed toward financing a self-insurance fund—that would be invested in liquid, highly rated, international assets—to bolster the economy’s resilience against natural disasters.

- The government’s commitment to adopting a fiscal rule to guide fiscal policy over the medium-term is welcome. To be effective, the fiscal rule should encompass a comprehensive definition of fiscal activities, including the fiscal costs of natural disasters and the lumpy expenditure associated with infrastructure investment. The fiscal rule should be part of a broader fiscal responsibility framework that embeds appropriate institutional and governance arrangements (including oversight and accountability) that ensure both the appropriate degree of flexibility as well as enforceability of the fiscal rule. The fiscal rule will need to be carefully calibrated to strike the balance between credibly meeting the debt target and providing space for much-needed resilience building.

- To support private sector investment, measures are needed to address inefficiencies in financial intermediation. The prolonged contraction of bank credit to the private sector remains a significant headwind to the domestic economy. This in part reflects banks’ steady efforts to repair their balance sheets, which should continue. However, there is scope to improve credit market efficiency by completing legislative initiatives to modernize foreclosure and insolvency legislation thereby facilitating recovery of impaired loans and collateral, adopting the harmonized legislation needed to establish a regional credit bureau and registry, and taking steps to allow for the greater use of movable property as loan collateral.

- Emerging financial sector risks warrant a more assertive approach to regulation and supervision. The contraction in domestic lending and excess liquidity have led local banks to increasingly allocate their asset portfolio to overseas debt securities. This has supported bank profitability but may also expose the sector to losses if global financial market conditions deteriorate and risk premia rise. The rapid expansion of credit union transactions and membership has increased the sector’s macro-financial significance. Loan delinquencies by credit unions are high and some institutions have relatively limited prudential buffers which increases the sector’s vulnerability to shocks. The swift adoption of the Harmonized Co-operative Societies Act, combined with a strengthening of supervisory oversight of the non-bank financial sector, remain key policy priorities. In addition, continued efforts are needed to satisfy international taxation and AML/CFT standards.

- St. Lucia is committed to further enhancing resilience to climate change and natural disasters. The government’s infrastructure programs include a commendable focus on building resilience to natural disasters. Progress has also been made in implementing recommendations of the 2018 Climate Change Policy Assessment including updating the national and sectoral adaptation plans, preparing a climate financing strategy, and mobilizing resources from the global climate funds. To address the remaining institutional and financing gaps in the climate adaptation and mitigation strategy, efforts are needed in the active costing of climate projects, improving public financial management of climate financing and outlays, and mobilizing private investment in mitigation and adaptation.

- Decisive and targeted reforms are needed to address supply-side impediments to long-term growth. Enhancing labor market performance and productivity will require a better alignment of the education system with labor market needs. There is also scope to improve the business environment especially by enhancing delivery of online government services and access to credit, reduce electricity costs by making greater use of renewable energy, further diversify the economy toward higher-value exports, and increase local content in the tourism supply chain.

IMF Haiti Staff Concludes Article IV Consultation Mission

November 25, 2019

End-of-Mission press releases include statements of IMF staff teams that convey preliminary findings after a visit to a country. The views expressed in this statement are those of the IMF staff and do not necessarily represent the views of the IMF’s Executive Board. Based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF’s Executive Board for discussion and decision.

Haiti is facing a grave political, economic, and social crisis. Repeated protests and lock-downs in the country since the summer of 2018 have led to recession and high inflation. Despite considerable efforts by officials at the central bank and ministry of finance, the economic and human costs of this political crisis have surged in recent months and are taking a heavy toll on an already poor and vulnerable population.

In the short term, the priorities are to restore macroeconomic stability, mobilize fiscal revenues, take steps to tackle corruption, and start to build a better social safety net, including developing a new pilot program of cash transfers to the poor.

The government should provide the agencies responsible for combating corruption with the legal and financial means necessary to fulfill their mandate. Elected officials, senior public servants, and judges need to comply with the asset reporting obligations required by law.

An International Monetary Fund (IMF) team, led by Ms. Nicole Laframboise, met with Haitian authorities in Port au Prince and Washington to conduct discussions on the Article IV Consultation. Upon conclusion of the meetings, Ms. Laframboise issued the following statement:

“We would like to extend our sincere thanks to the Haitian authorities, government officials and representatives of the private sector and civil society for their time and assistance over the past two weeks. They made it possible to undertake this consultation, in spite of a very challenging situation in Haiti.

“The political, economic, and social crisis confronting Haiti is without precedent. As a consequence of repeated lock-downs in the country in November 2018 and February, June, and September 2019, growth for the 2019 fiscal year is expected to be negative, at about -1.2 percent, while inflation rose to above 20 percent at end-September. This has worsened poverty and insecurity and deprived the government of the means to make productive investments and support activity.

“The ad referendum program agreed with Fund staff under the Extended Credit Facility (ECF) in March was shelved because of the absence of a government ratified by Parliament and able to commit the country to an economic reform program. This also led to the suspension of most external financial assistance.

“The staff outlook assumes a stabilization of the political situation but no fundamental political or economic reforms—which are unrealistic to assume at this juncture. Over the course of 2020, this would permit output to stabilize before a slight resumption of growth to around 0.9 percent in 2021. Under this scenario of low growth and external assistance, inflation is expected to remain close to 20 percent over the next two years. Likewise, potential growth is estimated at 1.5 percent per year over the longer term.

“It is important to note that a continuation of the current political crisis would have devastating consequences for the country over the longer-term owing to the likely losses of physical and human capital.

On the other hand, a rapid resolution to the crisis could lead to a strong rebound in activity. The appointment of a government committed to reforming the economy and the resumption of support from the international community would permit a loosening of budgetary constraints and an increase in public spending—investment in particular. This would reduce the need for financing from the central bank, thereby helping to lower inflation and boost growth in the short and medium-term.

“The immediate priority should be to stabilize the economy. In the absence of a formal budget submission to parliament, it is critical that the government prepare and publish a budget framework for 2020 as soon as possible. This notional budget should include measures to boost domestic revenues by strengthening tax administration and collection and reducing tax exemptions and take steps to rationalize non-priority spending.

We commend the authorities for adhering to the economic governance agreement between the central bank (BRH) and the Ministry of Economy and Finance which contributed to stabilizing inflation and the exchange rate over the summer. Renewal of this agreement would be key to again limiting monetary financing of the budget deficit, a key source of inflation.

“Staff commend the authorities for their efforts to finalize the draft of the National Plan for Social Protection and Social Progress (PNPPS) and urge the Council of Ministers to formally adopt this policy. The PNPPS should reduce the fragmentation and overlap of existing programs which at present lead to inefficiencies and hinder their effectiveness. IMF staff recommend establishing, within the PNPPS framework, a limited number of cash transfer programs for vulnerable groups —under the auspices of the Ministry of Social Affairs and Labor (MAST)—and to launch a pilot program as soon as possible.

“Combating corruption is another short-term priority. The Anti-Corruption Unit (L’Unité de Lutte Contre la Corruption, or ULCC) should be granted the legal and financial means to enable it to carry out its mandate in full. The government should set up the Steering Committee conceived under the 2009 National Anti‑Corruption Strategy, importantly with independent representatives from civil society, and it should participate in the drafting of the new anti-corruption strategy. In addition, the asset reporting obligations of elected officials, senior public servants, and judges—as stipulated in legislation (February 12, 2008)—must be enforced. Finally, as part of key anti‑money laundering measures to support anti-corruption efforts, banks should meet their obligations to “verify and know their customers”, particularly politically exposed persons.

“We sincerely hope that political stability will return and allow the government to build a consensus with key stakeholders in the country on a package of more extensive reforms in the areas of public finance management, governance, the structure and functioning of the energy sector, and the social safety net.

Haiti has the potential for much stronger and more inclusive growth. The IMF continues to provide policy advice and technical assistance, and stands ready to help with more intensive support when political conditions permit.”

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: RANDA ELNAGAR

PHONE: +1 202 623-7100 EMAIL: MEDIA@IMF.ORG

The Caribbean and its Linkages with the World:

A GVAR Model Approach

Author/Editor:Mauricio Vargas ; Daniela HessPublication Date:November 27, 2019Electronic

Access:Download PDF. Use the free Adobe Acrobat Readerto view this PDF file

Disclaimer: IMF Working Papers describe research in progress by the author(s) and are published to elicit comments and to encourage debate. The views expressed in IMF Working Papers are those of the author(s) and do not necessarily represent the views of the IMF, its Executive Board, or IMF management.

Summary: Using data from 1980-2017, this paper estimates a Global VAR (GVAR) model tailored for the Caribbean region which includes its major trading partners, representing altogether around 60 percent of the global economy.

We provide stilyzed facts of the main interrelations between the Caribbean region and the rest of the world, and then we quantify the impact of external shocks on Caribbean countries through the application of two case studies:

i) a change in the international price of oil, and

ii) an increase in the U.S. GDP. We confirmed that Caribbean countries are highly exposed to external factors, and that a fall in oil prices and an increase in the U.S. GDP have a positive and large impact on most of them after controlling for financial variables, exchange rate fluctuations and overall price changes.

The results from the model help to disentangle effects from various channels that interact at the same time, such as flows of tourists, trade of goods, and changes in economic conditions in the largest economies of the globe.

Series:Working Paper No. 19/256

IMF Barbados

Staff Concluding Statement of the 2019 Article IV and Second Review under the Extended Fund Facility

November 15, 2019

A Concluding Statement describes the preliminary findings of IMF staff at the end of an official staff visit (or ‘mission’), in most cases to a member country. Missions are undertaken as part of regular (usually annual) consultations under Article IV of the IMF’s Articles of Agreement, in the context of a request to use IMF resources (borrow from the IMF), as part of discussions of staff monitored programs, or as part of other staff monitoring of economic developments.

The authorities have consented to the publication of this statement. The views expressed in this statement are those of the IMF staff and do not necessarily represent the views of the IMF’s Executive Board. Based on the preliminary findings of this mission, staff will prepare a report that, subject to management approval, will be presented to the IMF Executive Board for discussion and decision.

Barbados continues to make good progress in implementing its ambitious economic reform program. The homegrown BERT (Barbados Economic Recovery and Transformation) plan aims to restore macroeconomic and debt stability, increase international reserves, and raise growth. International reserves, which reached a low of US$220 million (5-6 weeks of import coverage) at end-May 2018, have recovered to more than US$600 million by end-October 2019.

The completion of a domestic debt restructuring in late 2018 has been very helpful in reducing economic uncertainty, and the terms agreed with creditors have helped to put debt on a clear downward trajectory.

The agreement reached in October 2019 between the government of Barbados and the external creditor committee reduces debt and uncertainty. The agreed terms will bring about an immediate reduction in public debt, with a 26 percent haircut on principal and accrued interest, and will support further debt reduction, with a lower interest rate.

The terms of the new instrument will help Barbados reach its medium-term target of 80 percent debt/GDP by 2027/28, and 60 percent by 2033/34. The inclusion of a natural disaster clause in the new debt will help Barbados remain current on its debt obligations in the event of a natural disaster. By reducing uncertainty, the completion of the external debt restructuring improves prospects for investment.

The fiscal adjustment is proceeding as programmed, with the authorities targeting a 6 percent of GDP primary surplus for FY2019/20. Full year effects of reforms set in motion during FY2018/19, including the introduction of several new taxes (an airline travel fee, room levies, a new fuel tax, and a new health service contribution), are helping to achieve this target. A broadening of the base of the VAT and the land tax, implemented in March 2019 in the context of the FY2019/20 budget, are also supporting revenue.

The budget approved for FY2019/20 provides a solid basis for the targeted fiscal consolidation.

Reducing transfers to SOEs is key for sustainable fiscal consolidation. At close to 8 percent of GDP in FY2017/18, transfers to SOEs had become a significant burden on the budget, and a major contributor to fiscal risks. Under the BERT program, grants to SOEs are targeted to decline to under 6 percent of GDP by FY 2021/22, by a combination of:

(i) much stronger oversight of SOEs, supported by improved reporting and tighter control over SOE borrowing;

(ii) cost reduction, including reduction of the wage bill;

(iii) revenue enhancement, including an increase in user fees, combined with investments to improve services delivered by SOEs; and

(iv) mergers and divestment.

Together with addressing the fiscal dominance problem, the central bank needs to be equipped with tools and facilities to be able to manage liquidity consistent with the exchange rate peg. Following several years with high monetary financing, the Central Bank of Barbados (CBB) now provides liquidity to the government only to smooth unforeseen developments in revenue and spending.

A new CBB law will clarify the mandate of the CBB, enhance the decision-making structures of the central bank, and introduce safeguards to protect the institutional and functional autonomy of the CBB. Work on this new law is well underway.

The financial sector remains sound despite a significant impact from the domestic debt restructuring. Depositary corporations are in general well-capitalized and liquid. The authorities are providing explicit and time-bound regulatory forbearance targeting select financial institutions with high (post debt restructuring) concentration ratios until they rebuild capital buffers. With the expected improvements in the business climate and fiscal sustainability, credit growth is expected to pick up through increased confidence and enhanced opportunities for lending.

Structural reform is necessary to unlock Barbados’ growth potential. The authorities have started to address challenges related to the business climate with several initiatives. The process for providing construction permits has been streamlined. The credit bureau regime is being formalized by preparing a Fair Credit Reporting Act and a Code of Conduct for the operation of credit bureaus.

There is much scope for further improvement in the business climate, including by reforming customs administration to facilitate trading across borders, streamlining processes for setting up new businesses, and strengthening protection of minority shareholders.

Improving resilience to natural disasters and climate change will help strengthen the outlook. Given limited fiscal space and low fiscal buffers, it is important to make good use of contingent financing and insurance options. Barbados insures natural disaster risks through the Caribbean Catastrophe Risk Insurance Facility (CCRIF). With the inclusion of natural disaster clauses into the new domestic and external bonds, the government of Barbados effectively used the debt restructuring to strengthen its protection against natural disasters.

The authorities’ BERT program, supported by the IMF’s Extended Fund Facility, is on track. All program targets for end-September 2019 under the EFF have been met. The program target for primary surplus was met by a comfortable margin, which bodes well for reaching the FY2019/20 primary surplus target of 6 percent of GDP.

The Barbadian authorities also continue to make good progress in implementing structural benchmarks under the EFF. Following productive discussions, the IMF team and the Barbadian authorities reached staff-level agreement on the completion of the second review under the EFF arrangement. The agreement is subject to approval by the IMF Executive Board, which is expected to consider the review in December. Upon completion of the review, SDR 35 million (about US$48 million) will be made available to Barbados, bringing the total disbursement to SDR 105 million.

The team visited Barbados November 5-15 and would like to thank the authorities and the technical team for their openness and candid discussions.

Opening Remarks by Deputy Managing Director Tao Zhang at the 2019 Caribbean Forum

November 6, 2019

The Most Honorable Prime Minister Mia Mottley, Prime Ministers, Ministers and Central Bank Governors, Representatives of International Organizations

Public and Private Sector Participants, Friends and Colleagues:

Good morning.

Welcome to the 2019 Caribbean Forum on Regional Transformation. I am very glad to see old friends, and new faces. Thank you all for sharing your time with us today. I would also like to thank the Government of Barbados for its warm hospitality, and Prime Minister Mottley for her strong support for the Forum. I would also like to thank the Caribbean Development Bank for their great effort in co-organizing this event with us.

The annual Forum—the ninth in the series—is an important platform for brainstorming and collaborating with key stakeholders on the challenges facing the region and the possible solutions to address them.

This is the first time I have the pleasure of visiting this beautiful country. Let me congratulate Barbados on its excellent progress in implementing the Barbados Economic Recovery and Transformation Program, or better known to some of you as simply “BERT.” Public debt is now on a clear downward trajectory, which is one welcome indicator of the progress being made under “BERT.”

Hurricane Dorian

I also want to express my deepest sympathies to the government and people of the Bahamas for the loss of life and devastation caused by Hurricanes Dorian. The recent hurricane has once again highlighted the special vulnerabilities of the Caribbean, and the continued need to strengthen resilience. I am glad that this forum will devote a special session to explore a better way to build resilience.

Regional Transformation

The theme of this forum is regional transformation. I think this is important, because regional transformation is essential to support higher economic growth for the Caribbean. For too long, economic growth in the Caribbean has languished, offering too few opportunities, in particular, for its young people. This has led to rising social and economic challenges—including poverty, inequality, unemployment, and crime.

Transformation is the “T” in Barbados’ BERT program. It is about exploring the opportunities that new technology offers and overcoming obstacles that have held back the region for too long. So, what can be done to move forward? That is what brings us together this morning.

As reflected in our agenda, to those of us working in this area, three areas are vital to regional transformation: (1) regional integration and leveraging common institutional arrangements; (2) working towards a disaster resilience strategy; and (3) improving tax policy. Let me offer a few brief thoughts on these topics, before passing the baton to our panelists.

The first is Regional Integration

Deeper economic integration within the Caribbean has been a priority since the establishment of CARICOM in 1973, but progress has been limited. Recent work by IMF staff found that greater intraregional trade and mobility of people and capital could generate significant macroeconomic benefits.

Today’s discussion will look at possible actions to boost the regional integration process. One example would be reducing non-tariff barriers and trade costs stemming from the absence of harmonized customs laws. Another would be removing legal restrictions that constrain the free movement of people and capital.

Second, Climate Change and Disaster Resilience Strategy

As I mentioned earlier, climate change is expected to intensify the impact of natural disasters and worsen the vulnerabilities of small states in the Caribbean. Rising sea levels increase risks of erosion and flooding, and warmer water temperatures heighten the potential for more intense hurricanes. We must come together to address the challenges posed by climate change and help those most affected by it.

Recent IMF analysis identified a three-pillar strategy for building structural, post-disaster, and financial resilience.

Structural resilience will require infrastructure and other investment to limit the impact of disasters.

Post-disaster resilience aims to facilitate a speedy recovery after an event, supported by contingency planning such as emergency response planning and related investments.

Emergency relief and financing the reconstruction effort following catastrophic events like Hurricane Dorian is a key responsibility of the global community. Soon after the hurricane hit, leaders of the CARICOM showed strong solidarity with The Bahamas, including by deploying security forces.

Financial resilience is built based on fiscal buffers and using pre-arranged financial instruments to protect fiscal sustainability and mange recovery costs. Recognizing the need to support our members in the event of a natural disaster, the IMF has recently increased access to both our Rapid Financing Instrument and to our Rapid Credit Facility to 50 percent of quota per year and 100 percent of quota on a cumulative basis. Several countries in the region, including Dominica, Saint Lucia, and Saint Vincent and the Grenadines, have made use of the RCF over the last decade.

Two countries are piloting a Disaster Resilience Strategy: Grenada and Dominica. I look forward to hearing their experiences, including more about their challenges and constraints.

Lastly, Improving Tax Policy

All Caribbean countries face the challenge of how to maintain a tax system that is competitive, while also raising adequate revenue. In the regional context, avoiding a race to the bottom could provide substantial collective benefits. But how to achieve this is a problem that has challenged the region for decades—in particular, in light of the bargaining power of large tourism services providers. Today’s discussion provides an opportunity to hear views from policy makers, taxation experts, and industry representatives on these points.

Conclusion

To conclude, I would like to highlight the great importance I place on today’s discussions, which I am confident will benefit all of us. I would also like to emphasize that the IMF remains fully committed to assisting and supporting the Caribbean countries. I look forward to fruitful discussions and engaging with all of you on the important topics before us. Thank you very much.

IMF Jamaica

Executive Board Completes Sixth and Final Review under the Stand By Arrangement

November 4, 2019

The Executive Board of the International Monetary Fund (IMF) completed the sixth and final review of Jamaica’s performance under the program supported by the Stand-By Arrangement (SBA).

Jamaica’s sustained policy discipline, together with a fully operational fiscal council and an independent central bank, will help institutionalize the gains achieved under the successive Fund-supported programs.

Supply side reforms are needed to promote inclusive growth and reduce poverty, which requires productivity-enhancing public investments in human and physical capital, strengthened governance, greater financial inclusion, and tackling crime.

On November 4, 2019, the Executive Board of the International Monetary Fund (IMF) completed the sixth and final review of Jamaica’s performance under the program supported by the Stand-By Arrangement (SBA).

The 36-month SBA, with a total access of SDR 1,195.3 million (about US$ 1.65 billion), equivalent to 312 percent of Jamaica’s quota in the IMF, was approved by the IMF’s Executive Board on November 11, 2016 (see Press Release No.16/503). The Jamaican authorities continue to view the SBA as precautionary until the program expires on November 10, 2019, an insurance policy against unforeseen economic shocks that could lead to a balance of payments need.

Following the Executive Board’s discussion today, Mr. Tao Zhang Deputy Managing Director and Acting Chair issued the following statement:

“The Jamaican authorities have demonstrated an exemplary commitment to reforms under two consecutive IMF‑supported programs that have spanned the last 6 and a half years. Difficult reforms have been implemented–with considerable sacrifices by the Jamaican people–that have institutionalized fiscal discipline and led to substantial reduction in public debt, which is now on track to meet the legislated target of 60 percent of GDP by March 2026. The unemployment rate is at an all‑time low, inflation is subdued, the financial system is less vulnerable, and international reserves are comfortable.

“The authorities are committed to sustain policy discipline after the conclusion of the SBA. The government’s request to the Economic Programme Oversight Committee to continue monitoring its macroeconomic targets and reform commitments will support public accountability until the fiscal council becomes fully operational, while the proposed amendments to the BOJ Act will improve central bank governance and independence, allowing a greater focus on the central bank’s price stability mandate. These reforms, together with a well‑functioning public bodies’ governance framework and a natural disaster financing policy, will help institutionalize the gains achieved under the Fund-supported programs.

“Important gains have been made in the oversight of financial institutions. The next steps should include enhanced group‑wide supervision of financial conglomerates, improving data and analytics, better coordination among financial regulators, an improved legislative framework for the resolution of financial intermediaries, and further strengthening of the AML/CFT framework.

“Supply‑side reforms are needed to promote inclusive growth and lower poverty. This requires productivity‑enhancing public investments in human and physical capital, strengthened governance, greater financial inclusion, prioritizing measures to combat crime, and implementing policies that will help build resilience to natural disasters and weather fluctuations. To create fiscal space for these efforts, the government will have to strengthen fiscal institutions and modernize the compensation framework for public employees.”

Jamaica : Sixth Review Under the Stand-By Arrangements-Press Release; Staff Report; and Statement by the Executive Direct for Jamaica

Author/Editor:International Monetary Fund. Western Hemisphere Dept.Publication Date:November 7, 2019Electronic

Summary:

The 3-year Stand-By Arrangement (SBA) terminates shortly after conclusion of this sixth and final review. As Jamaica graduates from 6½ years of continuous Fund supported reform programs over two successive arrangements, macroeconomic stability has been entrenched with substantial fiscal over-performance and efforts to address structural weaknesses.

Public debt has been significantly reduced, unemployment is at a historic low, credit recovery is gaining force on the back of substantial monetary easing, FX reserves are comfortable, and inflation is subdued. However, for most of the past 6 years, growth has been low. The authorities are committed to policy continuity, safeguarding the hard-earned economic gains, and promoting growth and job creation.Series:Country Report No. 19/338

Jamaica: On the Path to Higher Economic Growth

Jamaica has successfully concluded its economic reform program, which was supported by a US$1.66 billion Stand-By Arrangement from the IMF. The country’s strong ownership, as well as the government’s steadfast reform implementation have resulted in a stronger economy, an all-time low unemployment rate, and a significant reduction in public debt.

In an interview with Uma Ramakrishnan, former head of the IMF team for Jamaica, we discuss the history, evolution, and achievements of the recently-concluded program.

How would you describe Jamaica’s economy before the program?

Prior to the IMF-supported programs, Jamaica’s economy suffered from years of very low growth. This was combined with high and unsustainable public debt of about 145 percent of GDP, which was accumulated over several decades of weak policy implementation. High borrowing needs to finance public debt led to financial repression—the use of various measures to channel funds to the government—and crowded out private sector credit and investment. These high debt servicing costs limited room in the government’s budget and inhibited spending on critical needs of the Jamaican people—like infrastructure and social assistance. A weak external position was reflected in a current account deficit of around 12 percent of GDP, and low net international reserves of around US$0.9 billion in 2012.

And how is Jamaica’s economy now?

The key goals under the two successive IMF-supported programs were to restore economic stability, while pursuing policies that will provide a long-term foundation to sustain growth, create jobs, and protect the most vulnerable. Since the start of the 2013 Extended Fund Facility and the subsequent precautionary Stand-By Arrangement in 2016, Jamaica’s public debt has fallen by about 50 percent of GDP and is on track to reach the legislated 60 percent of GDP target by FY25/26.

The unemployment rate—at about 7.8 percent—is at an all-time low. Both the current account deficit and inflation are subdued, and foreign reserves have been rebuilt to comfortable levels. In addition, monetary policy is on track to bring inflation to the mid-point of the Bank of Jamaica’s target band. Growth has improved—supported by mining, construction, and agriculture industries but the outlook is weaker than envisioned at the start of the programs, and poverty remains high.

To follow up, now that the program has ended, is there a risk that remaining reforms will go unfinished?

We are confident that there is still momentum and commitment to continue reforms in several key areas to support broad-based and higher growth. This includes completing the work on building domestic institutions, such as a fiscal council, an independent central bank, a disaster financing policy framework, and a well-functioning governance framework for public bodies.

Moreover, a meaningful transformation of the public sector that prioritizes government functions and redesigns public sector compensation needs to be at the top of the government’s agenda. This should help create room for fiscal policy to tackle growth impediments such as the large infrastructure and skills gap; high crime; low financial access and inclusion; and an inadequate social safety net.

Can you talk more about what contributed to the program’s successful completion?

A big reason for the success of the economic reform program in Jamaica resulted from the power of ownership. For instance, there was strong bipartisan support for fiscal discipline, and the social consensus to sustain it.Various stakeholders—for example, private and public sectors, civil society, unions—got behind the reforms across two administrations.

That social partnership for change and the championing and monitoring of reform commitments by the Economic Programme Oversight Committee (EPOC) was a critical force, which will need to continue to tackle the deep-rooted structural issues. In addition, phasing-in difficult reforms was critical (for example, the switch from direct to indirect taxes, increasing public employees’ pension contributions, and central bank recapitalization were all done over multiple years).

Going forward, how do you see the partnership between Jamaica and the IMF evolving?

First and foremost, the strong partnership between Jamaica and the Fund will continue through our regular economic health checks and capacity development—that is well-tailored for Jamaica, as it was under the program. More specifically, technical assistance to support economic and fiscal capacity building, foreign exchange and capital market development, and risk-based supervision are ongoing. Jamaica’s Resident Representative’s office will also remain open for two additional years to help coordinate these efforts and ensure that the authorities’ needs are being met.

jamaica-fast-facts-nov7-v4

Suriname

President Sentenced to 20 Years in Prison for 1982 Killings

SAN JUAN – A military court sentenced President Desi Bouterse to 20 years in prison over the killings of 15 political opponents in 1982, court officials reported.

As soon as the verdict was known, the opposition called for the resignation of Bouterse, who is in China and scheduled to travel to Cuba.

The court has not yet ordered his arrest, according to court officials, who said that Bouterse can appeal the verdict. The government said in a statement that it had taken note of the decision by the military court and called for peace in the country, a former Dutch colony.

In the first reactions pouring in after the ruling, Dutch Foreign Minister Stef Blok posted a joint declaration from the heads of mission accredited to Suriname of France, Germany, the Netherlands, Spain, the United Kingdom and the United States.

The statement commended the court and said it was “critical” that the final verdict after the appeals process be “implemented and upheld in accordance with the rule of law.”

“The verdict will undoubtedly prove instrumental in helping the nation move towards reconciliation,” the statement added.

Bouterse led a group of 16 army sergeants in a violent military coup d’etat in February 1980 to overthrow the Henck Arron government and become the country’s de facto leader. Months later, in August of that year, he also managed to remove president Johan Ferrier, who was succeeded by Henk R. Chin A Sen, and established a National Military Council.

Differences between the civilian government and the armed forces arose in 1981 owing to an attempt to reduce the power of the military and led to the resignation of Chin A Sen in February 1982.

A provisional constitution was approved that year, under which the government was elected by the NMC. Bouterse held the country’s presidency for days on two occasions, following the 1980 coup and after the president’s resignation in 1982.

Following a succession of clashes and uprisings, violently suppressed by the military, on Dec. 8, 1982, 15 opponents of the military regime were executed in Fort Zeelandia in the capital, Paramaribo, a case for which Bouterse was convicted. He was elected president in 2010 and re-elected in 2015.

OBITUARIES

Satnarayan Maharaj 1931-2019

Patriot and pioneer of education, culture, faith, media and women’s welfare

From 1952 the Sanatan Dharma Maha Sabha opened over 50 schools across Trinidad, under its patron, burly Bhadase Sagan Maharaj, tycoon, landowner, union leader and heroic founder of the Democratic Labour Party, and his son-in-law, the indomitable Civil Rights warrior, Sat Maharaj.

Based in the cosmopolitan, spiritual heart of UWI, SDMS runs five secondary schools.

Radio Jaagriti 102.7 FM began broadcasts in 2007 after a legal battle over 8 years against callous discrimination, culminating in a Judgment of the Privy Council. SDMS also operates TV Jaagriti promoting oriental entertainment, values and traditions.

Efforts as a champion of democracy led to a change of name of the highest award to the Order of Trinidad and Tobago. Educated at Canadian Presbyterian schools in Caroni, San Juan, Biche and Plum Road, Sat worked in the picturesque government estate as it evolved into a regional education hub, named after the first Archbishop of Canterbury, beneath the abbey of St. Benedict, patron saint of Europe.

From 1921 the Imperial College of Tropical Agriculture offered diplomas to students of the Empire on 84 acres at St Augustine on the Caroni Plain, at the foothills of the Northern range. North of ICTA, in 1931 the Canadian Presbyterian Church founded the vocational Archibald Institute offering domestic science, the first post-primary school for girls.

South of ICTA in 1950 the Presbyterians founded the academic St. Augustine Girls’ High School.

At the heart of ICTA prize-winning Lakshmi Girls’ Hindu College, founded in 1964, the first secondary school and first girls college run by the Sanatan Dharma Maha Sabha Board of Education produced 5 consecutive President’s Medallists and 40 scholarship winners, the most in 2019, sealing the reputation for excellence.

ECO, patron of UWI, LGHC and AVI, salutes the intrepid Indo-Caucasian intellectual seeking justice, undeterred by dystopian persecution and bureaucratic tyranny of ruthless regimes.

David Renwick 1938-2019

The departure of the regional energy champion had a special poignancy on the day when first oil flowed from the Guyana offshore basin. The pioneering energy journalist began his career in the media in the 1950s, following experience in Fleet Street in London.

He was a former CEO of Newsday and one of the founding directors of Daily News Ltd, its publisher.He co-founded Energy Caribbean magazine with publisher MEP. He was an editor of the Express and a energy journalist with the Guardian.

Trinidad Energy Minister Franklin Khan, said Renwick developed his skill over the last four decades and perfected it into a fine art. “He was by far the premier energy reporter in the Caribbean. He had the ability to report on energy matters in a very transparent manner and lucidly.”The new generation of energy reporters can learn from Renwick by reading his articles.……“His articles were very professional, factual and very, very analytical. He showed no emotion and no preconceived ideas. He will be remembered as the premier energy reporter most definitely in TT and possibly the Caribbean.”

He received a Hummingbird Medal Gold for contributions to journalism in 2008. He supported the IBC conferences and the Energy Chamber conferences where his friendly, cooperative manner was widely admired.

ECO continues his legacy documenting energy developments in the Caribbean Basin in its free online journal.

Robert Montano 1922-2019

Energy Chamber CEO Energy Chamber CEO Dr Thackwray Driver presents an award to energy visionary Robert Montano during the chamber’s energy conference and trade show in 2016. – Media Mill Limited/Energy Chamber

Robert Montano is credited with shaping the landscape of San Fernando and the development of the Point Lisas Industrial Estate.

The visionary businessman was the brother of former San Fernando East MP Gerard Montano and uncle of former senators Danny and Robin Montano. He was the founder of the South Trinidad Chamber of Industry and Commerce, predecessor of the Energy Chamber and the Point Lisas Industrial Port Development Co Ltd (Plipdeco) which led to the formation of the Point Lisas Industrial Estate.Former energy minister Kevin Ramnarine said:

“He was a giant. We don’t make them like that again in this country. People like him, Sydney Knox, Jeffrey Stollmeyer, those post World War II heroes who built TT in the 1950’ and 1960s. He was a pioneer of the modern TT economy.”Ramnarine recalled “I will never forget the outstanding picture he cut dressed completely in a white suit with all his medals pinned on him from World War II. He had a cane and was wearing a hat. This country owes him a debt of gratitude.”

“On behalf of the Energy Chamber, I want to express condolences to Mr Montano’s family. He was an absolutely wonderful gentleman.. very passionate, eloquent and intelligent visionary. His vision for south Trinidad led to the creation of the South Chamber. It was his drive to integrate the deepwater port and an industrial port in Pt Lisas that led to this world class petrochemical facility today,” As former president of the South Chamber Diane Seukeran remembered him as a pioneering activist who was passionate about the development of San Fernando.“Montano was an astute businessman who was nobody’s fool. He was a man who was sharp of tongue when necessary but a most charming and chivalrous gentleman.”

In Bequia he lost an eye after being robbed and beaten in his hotel room in 2014. Montano never quite recovered from that incident. He supported development of the Naparima Bowl and was a guest at the celebration of its 50th anniversary In 1975, Montano received the Hummingbird medal for his contribution to economic and cultural development.