APACHE AND TOTAL S.A. STRIKE OIL

APACHE CORPORATION AND TOTAL S.A. ANNOUNCE SIGNIFICANT OIL DISCOVERY OFFSHORE SURINAME

January 7, 2020 at 7:00 AM EST

-

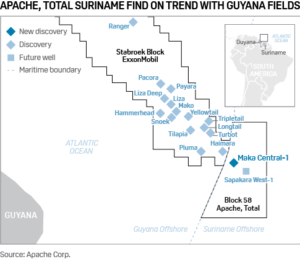

- Maka Central-1 well confirms geologic model with 73 meters (240 feet) of oil pay and 50 meters (164 feet) of light oil and gas condensate pay; appraisal planning is underway.

- Drilling at the next well, Sapakara West-1, approximately 20 kilometers (12 miles) southeast of Maka Central-1, will test the same-aged upper Cretaceous intervals in a separate and distinct stratigraphic feature.

HOUSTON, Jan. 07, 2020 — Apache Corporation and Total S.A. announced a significant oil discovery at the Maka Central-1 well drilled offshore Suriname on Block 58. The well was drilled by drillship Noble Sam Croft with Apache as operator holding a 50% working interest and Total holding a 50% working interest.

Maka Central-1 successfully tested for the presence of hydrocarbons in multiple stacked targets in the upper Cretaceous Campanian and Santonian intervals and encountered both oil and gas condensate. The formation evaluation program included logging-while-drilling and wireline logs, formation pressures, and preliminary core and fluid analysis. Together with future appraisal wells, this data will be used to quantify the resource in the Campanian and Santonian formations.

The shallower Campanian interval contains 50 meters (164 feet) of net hydrocarbon-bearing reservoir. Preliminary fluid samples and test results indicate light oil and gas condensate with API gravities between 40 and 60 degrees.

The deeper Santonian interval contains 73 meters (240 feet) of net oil-bearing reservoir. Preliminary fluid samples and tests results indicate API oil gravities between 35 and 45 degrees.

The Maka Central-1 also targeted a third interval, the Turonian, a geologic analogue to oil discoveries offshore West Africa. Prior to reaching this interval, the well encountered significantly over-pressured, oil-bearing reservoirs in the lower Santonian, and the decision was made to conclude drilling at approximately 6,300 meters (20,670 feet). The pressures encountered in the lower Santonian are a positive sign for the Turonian and future drilling will test this interval.

“We are very pleased with results from Maka Central-1. The well proves a working hydrocarbon system in the first two play types within Block 58 and confirms our geologic model with oil and condensate in shallower zones and oil in deeper zones. Preliminary formation evaluation data indicates the potential for prolific oil wells. Additionally, the size of the stratigraphic feature, as defined by 3-D seismic imaging, suggests a substantial resource,” said John J. Christmann, Apache CEO and President.

“Block 58 comprises 1.4 million acres and offers significant potential beyond the discovery at Maka Central. We have identified at least seven distinct play types and more than 50 prospects within the thermally mature play fairway. In partnership with Total, we look forward to advancing both exploration and development of discoveries on the block,” Christmann said.

The Sam Croft will drill the next wells in Block 58, starting with the Sapakara West prospect. Sapakara West-1, located approximately 20 kilometers (12 miles) southeast of the Maka Central discovery, will test oil-prone upper Cretaceous targets in the Campanian and Santonian intervals.

About Apache

Apache Corporation is an oil and gas exploration and production company with operations in the United States, Egypt and the United Kingdom. Apache posts announcements, operational updates, investor information and copies of all press releases on its website, www.apachecorp.com.

Forward-looking statements

This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects,” “guidance,” “outlook,” “projects,” “potential,” “will,” and similar references to future periods. These statements include, but are not limited to, statements about future plans, expectations and objectives for Apache’s operations, including statements about our capital plans, drilling plans, production expectations, asset sales, and monetizations. While forward-looking statements are based on assumptions and analyses made by us that we believe to be reasonable under the circumstances, whether actual results and developments will meet our expectations and predictions depend on a number of risks and uncertainties which could cause our actual results, performance, and financial condition to differ materially from our expectations. See “Risk Factors” in our 2018 Form 10-K filed with the U.S. Securities and Exchange Commission (“SEC”) for a discussion of risk factors that affect our business. Any forward-looking statement made by us in this news release speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future development or otherwise, except as may be required by law.

Cautionary note to investors

The SEC permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable, and possible reserves that meet the SEC’s definitions for such terms. Apache may use certain terms in this release, such as “resources,” “potential resources,” “resource potential,” “estimated net reserves,” “recoverable reserves,” and other similar terms that the SEC guidelines strictly prohibit Apache from including in filings with the SEC. Such terms do not take into account the certainty of resource recovery, which is contingent on exploration success, technical improvements in drilling access, commerciality and other factors, and are therefore not indicative of expected future resource recovery and should not be relied upon. Investors are urged to consider carefully the disclosure in Apache’s Annual Report on Form 10-K for the fiscal year ended Dec. 31, 2018, available from Apache at www.apachecorp.com or by writing Apache at: 2000 Post Oak Blvd., Suite 100, Houston, TX 77056 (Attn: Corporate Secretary). You can also obtain this report from the SEC by calling 1-800-SEC-0330 or from the SEC’s website at www.sec.gov.

Contacts Investor: (281) 302-2286 Gary Clark

Media: (713) 296-7276 Phil West

Website: www.apachecorp.com

APA-V

APA-G

Total made a deal to acquire a 50% working interest and operatorship in the Block 58 offshore Suriname in December last year. It was agreed that Apache would operate the first three exploration wells in the block, including the Maka Central-1 well, and subsequently transfer operatorship to Total.

Kevin McLachlan, Senior Vice President Exploration at Total said

“We are very pleased with this first significant oil discovery, made just after our entry into Block 58. The result is very encouraging and proves the extension of the prolific world-class Guyana Cretaceous oil play into Suriname waters. We are optimistic about the large remaining potential of the area still to be discovered and will test several other prospects on the same block.”

The Maka Central-1 exploration well was drilled by Apache as operator with 50% working interest and with Total as the JV partner with 50% working interest. The next exploration well will be drilled on the Sapakara West-1 prospect and the operatorship will be transferred to Total after completion of a third exploration well.

About Total

Total is a major energy player that produces and markets fuels, natural gas and low-carbon electricity. Our 100,000 employees are committed to better energy that is safer, more affordable, cleaner and accessible to as many people as possible. Active in more than 130 countries, our ambition is to become the responsible energy major.

Media Relations: +33 1 47 44 46 99 l presse@total.com l @TotalPress

Investor Relations: +44 (0)207 719 7962 l ir@total.com

Block 58 partners and analysts are optimistic about the Maka discovery, which is on trend with the gusher of Stabroek finds.

The “substantial” Maka find “dispels concerns about (primarily) gas condensate finds … based on results from the ExxonMobil [group’s] Haimara well in Guyana which was drilled toward the edge of Block 58. We view the discovery as clearly positive … given the multiple play types confirmed and the material oil pay encountered ,” Credit Suisse analyst Bill Featherston said.

Noble Sam Croft drillship; Source: Noble Corporation

Staatsolie Nearshore campaign

National oil company Staatsolie completed its Nearshore Drilling Project of six wells, but failed to make a commercial oil discovery.

Staatsolie drilled six exploration wells as part of its nearshore drilling campaign. While no commercial oil discovery was made, valuable data was collected.

The campaign started at the beginning of April this year, using the Seadrill-owned West Castor jack-up drilling rig, which will now be demobilized.

Initially, there were ten wells planned, with the probability of finding oil being between 10% and 27% with estimated extractable quantities of oil between 65 and 800 million barrels. Based on seismic data, forecasts were made and these wells were determined. Due to operational obstacles and the insights during the program, four wells were removed of the program.

Oil shows in Four of Six wells drilled at Marai, Electric Ray, Kankantrie, Powisi, Gonini and Tukunari confirm the potential of oil in the coastal area. The total depths of the wells varied from 1,000 to 3,000 meter in water depths from 8 to 25 meter.

The nearshore area has a size of 12,000 km2. Limited data is available because hardly any exploration has been done. , Staatsolie believes it is important to continue exploring this area. Now that well data has been collected, the seismic data can be associated with this specific information.

Apache has recently decided to drill even deeper at its first exploratory well in Block 58 offshore Suriname. The new target depth of the well is approximately 6,900 meters.

IMF Executive Board Concludes 2019 Article IV Consultation with Suriname

December 12, 2019

On December 11, 2019, the Executive Board of the International Monetary Fund (IMF) concluded the 2019 Article IV consultation [1] with Suriname.

Suriname’s economy is growing steadily with low inflation. Real GDP grew by 2.6 percent in 2018, following 1.8 percent in 2017. Activity growth has been broad based with expansions in wholesale and retail trade, construction, hotels, restaurants, and manufacturing, while mining has remained stable. Inflation has fallen below 5 percent mainly arising from exchange rate stability and control over excess liquidity. The unemployment rate was 7.6 percent in 2017 and is expected to have declined further in 2018. Real GDP is expected to expand annually by 2¼ to 2½ percent during 2019−24, while inflation is expected to remain low. However, the balance of risks to this outlook is negative, mainly due to fiscal imbalances. The overall fiscal deficit is expected to reach 8.6 percent of GDP in 2019 while public debt remains high at around 72 percent of GDP.

This year’s Article IV consultation focused on policies to bolster the economy in the medium term. These include fiscal measures to enhance revenues and efficiency and lower expenditures, policies to improve the monetary and financial sector supervision frameworks, and structural policies to boost potential growth.

Executive Board Assessment [2]

Executive Directors took positive note that the Surinamese economy is growing steadily, with a falling unemployment rate, low inflation, and a stable exchange rate. They stressed that this stabilization presents an opportunity to address the central challenges facing the economy, including a weak fiscal position and rising public debt, monetary and financial supervision frameworks that need to be enhanced, a low degree of economic diversification, and other structural impediments to growth. Timely action will be necessary to reduce macroeconomic vulnerabilities and downside risks.

Directors underscored the importance of putting public debt on a sustained downward path. They were encouraged by the authorities’ fiscal plans and emphasized the need to phase out electricity sector subsidies, implement the VAT, and continue to improve revenue and expenditure administration. Implementing these measures, while also protecting vulnerable households, would be instrumental in creating space for public investment and supporting long-term growth. Directors welcomed, in this context, the passage of the public financial management law.

Directors expressed concern about the resumption of monetary financing of the budget this year but welcomed the authorities’ plan to avoid any further such financing, including through a new Bank Act. They welcomed the recent introduction of new monetary tools and instruments and the preparation of several draft legislation to enhance the monetary framework. They underscored, nonetheless, that the central bank should also publish explicit monetary targets, further expand their operational tool box to implement effectively a reserve money target, and further strengthen coordination with the government on liquidity projections and operations. Directors generally agreed that a more flexible exchange rate is needed to act as a shock absorber.

Directors recognized that important vulnerabilities remain in the financial sector. They urged the central bank to revamp its supervisory actions and take a more assertive approach to ensuring banks’ return to compliance with regulatory requirements over a pre-determined time horizon. A comprehensive crisis management system is needed to give the central bank the power to intervene in banks’ governance and operations when necessary, as well as improve bank resolution. Directors looked forward to approval of draft legislation in these areas as soon as feasible. Directors were encouraged that the authorities have embarked on a national risk assessment this year to further enhance the AML/CFT framework.

Directors underscored the importance of diversifying the economy and implementing structural reforms to boost potential growth. Addressing the high costs of doing business, reforming the investment framework, and strengthening governance will be important to support investor confidence. Investment in education and labor market reforms, combined with a meaningful safety net for the unemployed, will also be important. Directors were encouraged by recent laws on the minimum wage and the enhancement of maternity and paternity support. They welcomed the authorities’ commitment to strengthen governance in the extractive sector.

Suriname: Selected Economic Indicators |

|||||||

| Proj. | |||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Real sector (percent change) | |||||||

| Real GDP | 2.6 | 2.3 | 2.5 | 2.4 | 2 | 2.4 | 2.5 |

| Nominal GDP | 7.4 | 11.8 | 12.6 | 8 | 10.7 | 6 | 6.7 |

| GDP deflator | 4.6 | 9.3 | 9.9 | 5.5 | 8.5 | 3.6 | 4.1 |

| Consumer prices (period average) | 6.9 | 4.5 | 5.8 | 4.7 | 10.2 | 5.1 | 4.8 |

| Consumer prices (end of period) | 5.4 | 4.8 | 4.8 | 5.7 | 8.3 | 5.2 | 4.4 |

| Labor market (percent) | |||||||

| Unemployment rate | 7.1 | 6.7 | 6.3 | 5.9 | 5.5 | 5.1 | 4.7 |

| Labor force participation rate | 60.2 | 60.6 | 60.9 | 61.2 | 61.5 | 61.8 | 62.2 |

| Money and credit (percent change) | |||||||

| Broad money (constant exchange rate) | 8.1 | 9.5 | 9.4 | 7.6 | 7.5 | 7.5 | 7 |

| Broad money (local currency; percent of GDP) | 28 | 28.8 | 29.3 | 29.7 | 29.4 | 30.2 | 30.7 |

| Reserve money (constant exchange rate) | 35.4 | 14.8 | 12.6 | 8.6 | 8.5 | 8.5 | 7.6 |

| Reserve money (percent of GDP) | 19.3 | 19.9 | 19.9 | 20.1 | 19.7 | 20.2 | 20.4 |

| Private sector credit (constant exchange rate) | -4.5 | -4.7 | 7.4 | 12.8 | 10.6 | 14.5 | 12.8 |

| Private sector credit (percent of GDP) | 28.2 | 24.3 | 23.4 | 24.8 | 25 | 27.1 | 28.9 |

| Central government (percent of GDP) | |||||||

| Revenue and grants | 23.9 | 25.4 | 24.9 | 24.9 | 26.3 | 26.2 | 26 |

| Total expenditure | 31 | 34 | 33.8 | 33.2 | 32.7 | 33.8 | 33.5 |

| Of which: Primary expenditure | 27.1 | 30.2 | 29.9 | 29.1 | 28.9 | 28.8 | 28.7 |

| Statistical discrepancy | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Overall balance (net lending/borrowing) 1/ | -7.1 | -8.6 | -8.9 | -8.2 | -6.4 | -7.6 | -7.5 |

| Primary balance | -3.5 | -4.8 | -5 | -4.1 | -2.7 | -2.6 | -2.7 |

| Net acquisition of financial assets 2/ | -11.9 | 0 | 0 | 0 | 0 | 0 | 0 |

| Net incurrence of liabilities | -4.8 | 8.6 | 8.9 | 8.2 | 6.4 | 7.6 | 7.5 |

| Net domestic financing | 8.3 | 2.8 | 2.8 | 2.7 | 2.3 | 2.6 | 2.6 |

| Net external financing | 1.4 | 5.8 | 6.1 | 5.5 | 4.2 | 5 | 4.9 |

| Central government debt 3/ (percent of GDP) | 72.1 | 72.3 | 74.6 | 79.5 | 79.5 | 83.8 | 87.4 |

| Domestic | 22.5 | 21 | 21.8 | 23.3 | 23.8 | 25.6 | 27.2 |

| External | 49.6 | 51.3 | 52.8 | 56.3 | 55.7 | 58.2 | 60.1 |

| External sector (percent of GDP) | |||||||

| Current account balance | -3.4 | -6.1 | -5.9 | -4.5 | -3.3 | -4.8 | -4.3 |

| Capital and financial account | 8.6 | 9.5 | 8.5 | 4.4 | 4.2 | 4.6 | 3.6 |

| Overall balance | 4.5 | 3.4 | 2.6 | -0.1 | 0.9 | -0.2 | -0.6 |

| Financing | |||||||

| Change in reserves (- = increase) | -4.5 | -3.4 | -2.6 | 0.1 | -0.9 | 0.2 | 0.6 |

| Memorandum items | |||||||

| GDP at current prices (SRD billions) | 25.8 | 28.8 | 32.5 | 35.1 | 38.8 | 41.2 | 43.9 |

| Terms of trade (percent change) | -3.7 | 6.7 | 7.7 | 1 | 0.2 | -0.2 | -0.5 |

| Gross international reserves (USD millions) | 581 | 710 | 819 | 814 | 857 | 847 | 813 |

| In months of imports | 2.9 | 3.6 | 3.7 | 3.6 | 3.7 | 3.5 | 3.3 |

| Gold price (USD per troy ounce) | 1,269 | 1,400 | 1,531 | 1,558 | 1,580 | 1,599 | 1,619 |

| Oil price (USD per barrel) | 68.3 | 61.8 | 57.9 | 55.3 | 54.6 | 54.7 | 55.3 |

| Sources: Surinamese authorities and Fund staff calculations and projections. | |||||||

1/ The overall balance is computed using net financial transactions, and therefore, includes statistical discrepancy.

2/ Includes acquisition of stake in gold mine and loans to state-owned enterprises.

3/ The debt-to-GDP ratio is different when computed using the definition in the Government Debt Act of Suriname.

[1] Under Article IV of the IMF’s Articles of Agreement, the IMF holds bilateral discussions with members, usually every year. A staff team visits the country, collects economic and financial information, and discusses with officials the country’s economic developments and policies. On return to headquarters, the staff prepares a report, which forms the basis for discussion by the Executive Board.

[2] At the conclusion of the discussion, the Managing Director, as Chairman of the Board, summarizes the views of Executive Directors, and this summary is transmitted to the country’s authorities. An explanation of any qualifiers used in summings up can be found here:http://www.imf.org/external/np/sec/misc/qualifiers.htm .

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: RANDA ELNAGAR

Suriname : 2019 Article IV Consultation-Press Release; Staff Report; Informational Annex; and Statement by the Executive Director for Suriname

- Suriname continues to grow steadily with low inflation. However, there has been little progress in implementing urgently-needed fiscal reforms, and the fiscal position is likely to continue to weaken in the coming year.

- Advances have been made in developing the central bank’s monetary tools and facilities, but more is needed to strengthen the credibility of the monetary framework.

- The banking sector faces important downside risks and there are gaps in the central bank’s supervisory and resolution framework. Annex I reports the implementation status of key prior Fund policy recommendations.

Country Report No. 19/391

Publication Date:December 23, 2019

ISBN/ISSN:9781513524498/1934-7685

Stock No:1SUREA2019001Price:$18.00 (Academic Rate:$18.00)

Format:PaperPages:85

Apache extends drilling window for offshore Suriname well

Apache Corp. has updated progress on its first exploratory well in block 58 offshore Suriname.

Dec 3rd, 2019

Location of block 58 offshore Suriname. (Courtesy Apache Corp.)

HOUSTON – Apache Corp. has updated progress on its first exploratory well in block 58 offshore Suriname.

Drilling of the Maka Central – 1 well started in late September and had been expected to last between 30 and 60 days.

However, on reaching a depth of around 6,200 m (20,341 ft), the company decided to conduct testing activities in two distinct Upper Cretaceous play types.

On completion of these tests, the plan is to set casing, make equipment modifications to the rig, and resume drilling in mid-December to evaluate a third play type in the Cretaceous.

The well’s new target depth is around 6,900 m (22,638 ft). Following the conclusion of drilling, the company plans further testing and evaluation.

12/03/2019

Belize

2019 Article IV Consultation-Press Release; Staff Report; and Statement by the Executive Director for Belize

December 9, 2019

Electronic Access:Download PDF.

Use the free Adobe Acrobat Reader to view this PDF file

Summary: Belize’s economic recovery continues but the pace is slowing. Real GDP grew by 3.2 percent in 2018, but recent data indicate a slowdown, reflecting a severe drought, with growth projected to average 2 percent during 2019-20. The primary fiscal surplus reached 2.1 percent of GDP in FY2018/19––a 4 percent of GDP rise from two years ago––but the primary surplus is expected to narrow this year and remain below 2 percent of GDP for the following two years. Public debt remains above 90 percent of GDP, the current account deficit is projected to remain large over the medium term, and international reserves are just below 3 months of imports of goods and services. The pace of structural reform has been slow. Downside risks, including from slower U.S. growth, natural disasters, crime, and renewed pressures on correspondent banking relationships (CBRs) could weaken growth and financial stability.

Series:Country Report No. 19/364

December 9, 2019

IDB names corrupt and slow regimes

Inter-American Development Bank (IDB) describes government transactions in T&T and across the Caribbean as a “hotbed of corruption” where citizens must pay bribes to access certain services. In Wait no More: Citizens, Red Tape and Digital Government, authors Benjamin Roseth and Angela Reyes state that “manual government transactions, face-to-face interactions, and the lack of standardized processes mean that transactions are vulnerable to dishonest behaviour.”

Trinidad officials said that they were unaware of people accepting bribes,

National Security Minister Stuart Young said: “No I am not. If you have any credible information on these very serious allegations I would like you to provide to me please.”

There was a similar response from Public Utilities Minister Robert Le Hunte.

The Police Commissioner said that the Police Service does not investigate based on “a Caribbean poll or allegations by anonymous persons from around the Caribbean. There have been dozens of reports on TTPS police officers pertaining to such incidents and with every report, it is thoroughly investigated.”

At times the investigations proved the allegations to have no merit and there had been “several investigations whereby police officers have indeed been charged.” This evidence shows that the TTPS “acts on such matters if and when called upon to do so….that the number of such cases is very low in comparison to the number of TTPS officers on duty.”

One reason citizens resort to paying bribes is the length of the transaction times for government services which Roseth and Reyes described as “slow and (they) generate transaction costs for both citizens and firms. Completing government transactions requires a lot of effort. Journeys, queues, waiting at the counter, filling out forms, reading communications, seeking information, sending letters, or even learning to use a new system or website: in short, a government transaction can be all-consuming.”

IDB- Guyana Government most corrupt

The Inter-American Development Bank (IDB) pinned Guyana at the top of the list in the Caribbean, where a large percentage of citizens are required to pay a bribe to access Government services.

The study, titled “Wait No More: Citizens, Red Tape and Digital Government” was released earlier this month and through surveys, a closer look was placed on the way business is done, the ease of doing it and access to services in the public sector among other factors.

It revealed that the lack of “standardised processes” makes it easier for dishonesty and insisted that corruption is everywhere. Looking at the data from the 2019 Transparency International survey, statistics from five countries showed that there was an 18 per cent average for persons who made payoffs for Government services.

“Manual Government transactions, face-to-face interactions, and the lack of standardised processes mean that transactions are vulnerable to dishonest behaviour. In fact, corruption is everywhere: 29 per cent of Latin Americans report having paid a bribe in the context of a public service in 2016. According to data from a 2019 Transparency International survey, the proportion of people in the five Caribbean countries surveyed that reported paying a bribe to access a public service was 18 per cent,” the document stated.

However, in Guyana, the figure is a glaring 27 per cent and regarded as the highest in the region. The lowest occurrence of such activity was recorded in Barbados with just 9 per cent.

“In Guyana, 27 per cent of those surveyed said they had to pay a bribe to access a public service, the highest proportion in the region, followed by 20 per cent in The Bahamas and 17 per cent in both Jamaica and Trinidad and Tobago. Barbados registered the lowest rate, with only 9 per cent of the surveyed reporting having paid a bribe to receive a public service.”

Throughout the Caribbean, the numbers were further broken down to name specific entities and agencies where these monies landed. Topping the list was utilities with 19 per cent, followed by the police at 18 per cent, voter’s identification and permits at 15 per cent, public schools standing at 10 per cent, and public hospitals at eight per cent. A small percentage of individuals bribed the courts.

Why there is such a high number of individuals who are willing to bribe their way through the system, rather than going through the due process. It speaks to the lack of flexibility to accommodate the working class, resulting in many persons opting to use an alternative which will not affect their income.

“One of the biggest problems of difficult Government transactions is their regressive character: they affect the poor more. People in this segment of the population generally enjoy less flexibility at work, which makes it difficult for them to ask for time off to carry out a Government transaction. Likewise, they are less able to forego lost income and have fewer resources to cover the costs incurred in carrying out transactions.”

With that, there are cases where the requirements and formalities are difficult to complete by persons who would not have accessed higher education. In essence, many earning a lower income benefit less from Government services.

“All of the above means that low-income people complete fewer transactions, which implies that they benefit less from Government services and programmes….Taking educational attainment as a proxy for income, it becomes clear that citizens with less education reported having completed fewer Government transactions in the last year. Only transactions associated with identity, education and health, social programmes, and transportation, as well as the reporting of crimes, were considered, as these transactions are assumed to have, at the very least, an even demand among different socioeconomic levels, or an over-representation of lower-income earners.”

In the past 12 months, only seven per cent of persons with no formal education and 17 per cent of those with primary school education completed a transaction, showing the disparity of the population and moreover, the amount of persons who were potentially engaged in bribery.

“The fact that low-income people carry out fewer Government transactions, even to access services that in theory would benefit them, has negative implications: Government programmes are not reaching their target beneficiaries, which reduces policy effectiveness,” the IDB data showed.

December 28, 2019

FULL TEXT:

“Wait No More: Improving Government Services in the Caribbean

by Angela María Reyes | Benjamin Roseth

It’s not unusual for Caribbean citizens or firms to expect that renewing a passport or registering a new vehicle will require them to spend a full day at a government office. That is, for those fortunate enough to complete their transactions in a single visit. On average, Caribbean citizens spent over 4 hours to complete their last government transaction. And this does not include the time waiting between multiple visits. Why are many government transactions in the region so complicated and time consuming and what can be done about it?

A recent study published by the Inter-American Bank (IDB): Wait No More: Citizen, Red Tape, and Digital Government: Caribbean Edition examines government transactions in the Caribbean and identifies 4 main problems. It also provides 5 recommendations to improve government service to citizens.

Problem 1- They Are Slow and Generate Transaction Costs for Both Citizens and Firms

Carrying out government transactions requires a lot of effort. Most transactions require many specific documents, long-lines, lots of questions and reading. Data from an IDB- Transparency International survey show that Caribbean people spent an average of 4.3 active hours completing their last government transaction. Compared to Latin American countries were citizens spent 5.8 hours on average, 4.3 hours may not seem that bad. However, very few transactions in the Caribbean can be carried out in just one visit. In Jamaica only 11% of transactions can be completed in 1 visit and 45% require 3 or more visits to complete. In Barbados only 23% of transactions can be completed in 1 visit and 43% require 3 or more office visits to complete. The report also discusses possible reasons for repeated visits including the existence of excessive requirements.

Problem 2- Government Transactions Are a Hotbed of Corruption

27% of people in Guyana reported having to pay a bribe to access a public service, 20% in The Bahamas and 17 % in Trinidad and Tobago and Jamaica. Manual government transactions, face-to-face interactions, and the lack of standardized processes means transactions are more vulnerable to corruption.

Problem 3- The Costs of Government Transactions Hit the Poor Harder

Government transactions affect the poor more. This segment of the population usually enjoys less flexibility at work, which makes it difficult to get time off to carry out government transactions. They also have fewer resources to cover the costs incurred in carrying out transactions. Complex forms that are hard to fill out, have a greater negative impact on people with lower educational attainment who lack the tools to navigate the system.

Problem 4- They are Expensive to Provide

In-person services are more expensive to provide due to personnel costs and other inputs such as office space and supplies. For example, in the United Kingdom a single in-person transaction costs the Government $15.32 USD, while the average online transaction costs $0.44 USD to administer. However, in the Caribbean, most Government transactions are not available online. Only 8% of citizens in the Caribbean report having carried out their last government transaction online.

The Bahamas, Barbados and Jamaica are currently implementing broad digital transformation programs to improve public services to boost the competitiveness of firms and to improve citizen experience. Also, the Government of Guyana has developed a broad program aimed at closing the digital divide by establishing ICT hubs that provide free access to the internet and equipment throughout the country.

Easy transactions are important for the competitiveness of firms. In terms of the ease of starting businesses in the Caribbean; Jamaica ranks in the top ten countries in the world. Since 2018 it has been possible to register a new company online. However, the other Caribbean countries are ranked much lower in this index even though their ‘Starting a business scores’ are much more positive.

What can governments do to improve the situation?

Study the Citizen Experience with Government Transactions

Developing a clear understanding of the citizen experience is the first step to improving service.

Eliminate as Many Government Transactions as Possible

The best government transaction is the one that does not have to be carried out. A single digital platform that stores and links citizen data reduces the number of transactions that would have to be carried out by individuals.

Redesign Government Transactions with the Citizen Experience in Mind

Once the citizen experience has been understood, and unnecessary government transactions have been eliminated, the next step is to redesign all necessary transactions to make them as easy, intuitive and fast as possible.

Facilitate Access to Digital Transactions

Once government transactions have been redesigned, the next step is to facilitate access through the digital channel. This relates to a complete framework for digital transactions including digital identity, digital signature, and electronic payments. It also involves expanding digital literacy programmes and guaranteeing that all online services work from any device.

Invest in High-Quality Face-to-Face Government Transactions

90 % of all government transactions are still carried our in-person therefore it is vital to improve face to face service while progress is being made in digital development. This requires investing in and empowering staff who directly interact with members of the public and exploring the integration of services by providing many government services under one roof.

Angela María Reyes works in the Innovation for Citizen Services Division at the Inter-American Development Bank on issues related to modernization of the state, digital government and citizen centered services. Before joining the IDB, she worked on innovation in local governments through the Ash Center for Democratic Governance and Innovation of Harvard University. Previously, she was an advisor at the Macroeconomic Policy Department of the Ministry of Finance of Colombia and an analyst at EConcept, a Colombian economic consulting firm. She holds a M.A. in Public Policy with a concentration in Social and Urban policy from Harvard Kennedy School of Government, a M.A. in Economics from Universidad de Los Andes in Colombia and a B.A. in Economics from the same university.

Benjamin Roseth is a Modernization of the State Specialist at the Inter-American Development Bank. He coordinates the analytical work of the Innovation for Citizen Services Division, including impact evaluations, cost-benefit analyses and other research on digital government and public sector reform in Latin America and the Caribbean. As a Young Professional at the IDB, he worked in the Office of Evaluation and Oversight. Before joining the IDB, he was a strategy consultant at Deloitte and a Junior Professional Associate at the Public Sector Governance unit of the World Bank. He has a M.A. in International Affairs with a concentration in Economic Development from Columbia University, a B.A. in International Relations from Tufts University, and a B.A. in Music Performance from the New England Conservatory.”

The UWI to facilitate inter-regional climate risk learning

DECEMBER 16, 2019

UWI

The year 2019 once again proved challenging for many communities around the world who are living at the frontlines of climate change. Low-lying island states especially were hit by a number of weather events, including hurricanes, tropical storms, tsunamis, excess rainfall, drought, storm surge and wave impacts making it clear that the need for adaptation solutions is pressing. In response to this climate emergency, the United Nations University Institute for Environment and Human Security (UNU-EHS), the Munich Climate Insurance Initiative (MCII), the University of the South Pacific (USP), The University of the West Indies (UWI) and the United Nations Pacific Financial Inclusion Programme (PFIP) have established the Climate Risk Insurance Research Collaboration (CRIRC) to facilitate inter-regional South-South learning and research.

“In addition to cutting emissions, we need to support the most vulnerable people with options to protect themselves against the impacts of more frequent and more intense weather events,” said Soenke Kreft, MCII Director. “Climate risk insurance can be such a measure if it is applied within a mix of other disaster risk reduction strategies. While the field of climate risk insurance has made great advancements in the last decade, it is still considered as an innovation in the field of climate change, and as such, it can benefit greatly from more systematic approaches, enhanced knowledge sharing and networking between regions and among different actors.”

With CRIRC, the partners have established a framework for coordination and collaboration on research, development and publication of academic research and policy papers on disaster risk finance, insurance and social payment.

One of the first research priorities for CRIRC is the informal economy in island states in the Pacific, which consists of informal entrepreneurs, who are vibrant and visible players creating a livelihood for themselves and their families. Working as fresh produce sellers, handicraft creators, beekeepers and fish and crab sellers, they operate outside the realm of formal legal protection and without easy access to formal financial and business support systems. They work as single-person operations or as micro or family enterprises, and women are predominant in these types of income-generating activities.

The extent and impact of damage caused by weather events, such as cyclones, means that many governments of Small Island States face critical challenges in ensuring their financial resilience to climate change and natural hazards. They often only have restricted options to secure funds for recovery and reconstruction without compromising their long-term fiscal balance.

The research partners therefore aim to work together to explore the socio-economic and regulatory needs and demands for disaster risk finance in small islands countries, to develop and assess innovative risk financing mechanisms, and to identify how disaster risk financing tools can be integrated into countries’ risk management and disaster response toolboxes.

“The University of the West Indies is duty-bound and privileged to be a partner in this initiative,” stated Professor Sir Hilary Beckles, Vice-Chancellor of The UWI. “As an activist university with regard to Climate Resilience, and one situated within a region where climate change is an existential threat, we regard it our duty to contribute our expertise in climate change adaptation, disaster risk reduction, and sustainable development; and to strengthen our ties with academics, national and local authorities of the Pacific Island Countries, who are facing many of the climate change-related challenges that we do.”

These sentiments are echoed by Dr. Donovan Campbell (UWI’s focal point for CRIRC) who noted that the recent losses and damages associated with disasters across the Caribbean has brought climate risk insurance into sharp focus. In the absence of easy access to debt and affordable, reliable insurance solutions, a large portion of the economic losses stemming from climate change events are currently being borne by governments, communities and households supported by development partners. Impact is felt for many years, resulting in an emerging population in climate poverty. CRIRC aims to identify ways to prevent this climate poverty in Small Islands Countries through improved climate insurance research cooperation and coordination.

The United Nations Capital Development Fund managed Pacific Financial Inclusion Programme has been at the forefront of pioneering market based micro-insurance solutions for the mass market in the Pacific through its work on financial inclusion in the region for over a decade. “We are excited to be actively collaborating with MCII and the three academic institutions, USP, UWI and UNU through this cooperation that aims to foster an active research and learning agenda in the new Pacific Insurance and Climate Adaptation Programme being developed” said Krishnan Narasimhan, UNCDF PFIP Deputy Programme Manager.

The expertise and familiarity of PFIP in the Pacific and its ability to bring together public and private sector for ecosystem and market systems development will add value to the cooperation.

BPC Bahamian fund for local investors

Bahamas Petroleum Company (BPC) has incorporated a Bahamas-based mutual investment fund with the aim of owning BPC shares as the company continues its work effort toward drilling of an exploration well in The Bahamas in 2020.

Source: BPC

BPC appointed Leno Corporate Services to advise on the creation of a Bahamian domiciled mutual fund investment fund with the sole mandate of owning BPC shares for the benefit of Bahamian investors.

The the fund had been incorporated, licensed, and would be open for receipt of initial subscriptions from January 6.

The initial subscription period will end on February 7, and the proceeds received from investor subscriptions will then be used for the purchase of ordinary shares in Bahamas Petroleum.

BPC stated that subscriptions and redemptions would be processed monthly, or more frequently if felt appropriate by the fund, while any additional proceeds raised by net subscriptions will be used to purchase ordinary shares in Bahamas Petroleum either directly or via existing issued shares on the AIM market of the London Stock Exchange.

The company agreed to issue up to 100 million ordinary shares at two pence per share to the fund. If the fund were to be issued this number of shares in full, gross proceeds to BPC would be the equivalent of £2 million, and the fund would hold approximately 4.47 percent of the enlarged issued share capital of BPC following the issuance of these new shares.

To the extent that the initial subscription proceeds of the fund exceed this predefined amount, the fund may either request to acquire additional new shares of the company.

Simon Potter, CEO of BPC, said: “It has long been the company’s intention to provide Bahamians a means of investing directly in this nationally significant project. While the royalty regime under which BPC operates ensures economic value for the people of the Bahamas via government revenues, the mutual fund initiative will allow Bahamian individuals to hold a stake in the outcome of this exciting and potentially transformational project, and thus to personally benefit should the project be successful.”

The company previously explained its rationale for creating the fund due to making progress towards the beginning of exploration drilling in the Bahamas in the late first quarter of 2020.

The rationale behind the creation of the fund was the fact that the company had made progress towards the beginning of exploration drilling in the Bahamas in the late first quarter of 2020.

BPC entered into a framework agreement with drilling contractor Seadrill, setting the terms for the potential use of Seadrill’s drilling rig for its first exploration well in the Bahamas in 2020. The company is currently working on finalizing a long-form rig contract with Seadrill and preparing for drilling.

BPC finalized an agreement with Baker Hughes for the provision of equipment for its first Bahamas well.

UK, CDB grant for Barbuda

The Caribbean Development Bank (CDB) approved a grant to reconstruct and rehabilitate the energy network in Barbuda. The project is being funded by the United Kingdom under its aid programme. The CDB-administered grant of GBP 2.85 million will finance the undergrounding of about half of the 16 kilometres electricity network of the island, and provide hybrid solar systems for backup power of key public buildings. About a quarter of the island’s 1000-strong population, who are still without permanent electricity, will also be reconnected.

“The works will make Barbuda’s energy network more resilient to storms and climate change and reconnect households, which have been off the grid since Hurricane Irma in 2017,” said CDB Vice-President (Operations),.

The current electricity system, which is completely reliant on the generation from imported fossil fuel, is vulnerable to severe damage from high winds. Furthermore, back-up generation for essential services, such as emergency shelters, hospitals and government offices is either non-existent or wholly dependent on fuel imports, making the island vulnerable to delays in the fuel supply chain. Moreover, since Hurricane Irma, more than 100 reconnected electricity customers are only receiving temporary power, while an additional 150 customers remain unconnected.

In the short run, the project will create jobs in construction, operation and maintenance of tools and machines. In the long run, the improved energy network is expected to accelerate the provision of electricity to businesses and households. The availability of resilient electricity infrastructure is a basic good necessary for the socioeconomic progress of households, private enterprise and the public sector. Through the provision of a stable source of power, the project will also contribute to lifting people out of poverty and lowering the country’s dependence on fossil fuels. According to estimates, the hybrid solar systems will reduce annual fuel consumption by 14,600 imperial gallons and carbon dioxide emissions by 107 tonnes.

At the social level, the reconnection programme will prioritise the most vulnerable households. “The United Kingdom is delivering support to the Barbudan people to have a more resilient power supply that is less susceptible to hurricane damage. We are pleased that our support will help the most vulnerable households, such as those receiving social assistance,” said Resident British Commissioner to Antigua and Barbuda, Lindsy Thompson.